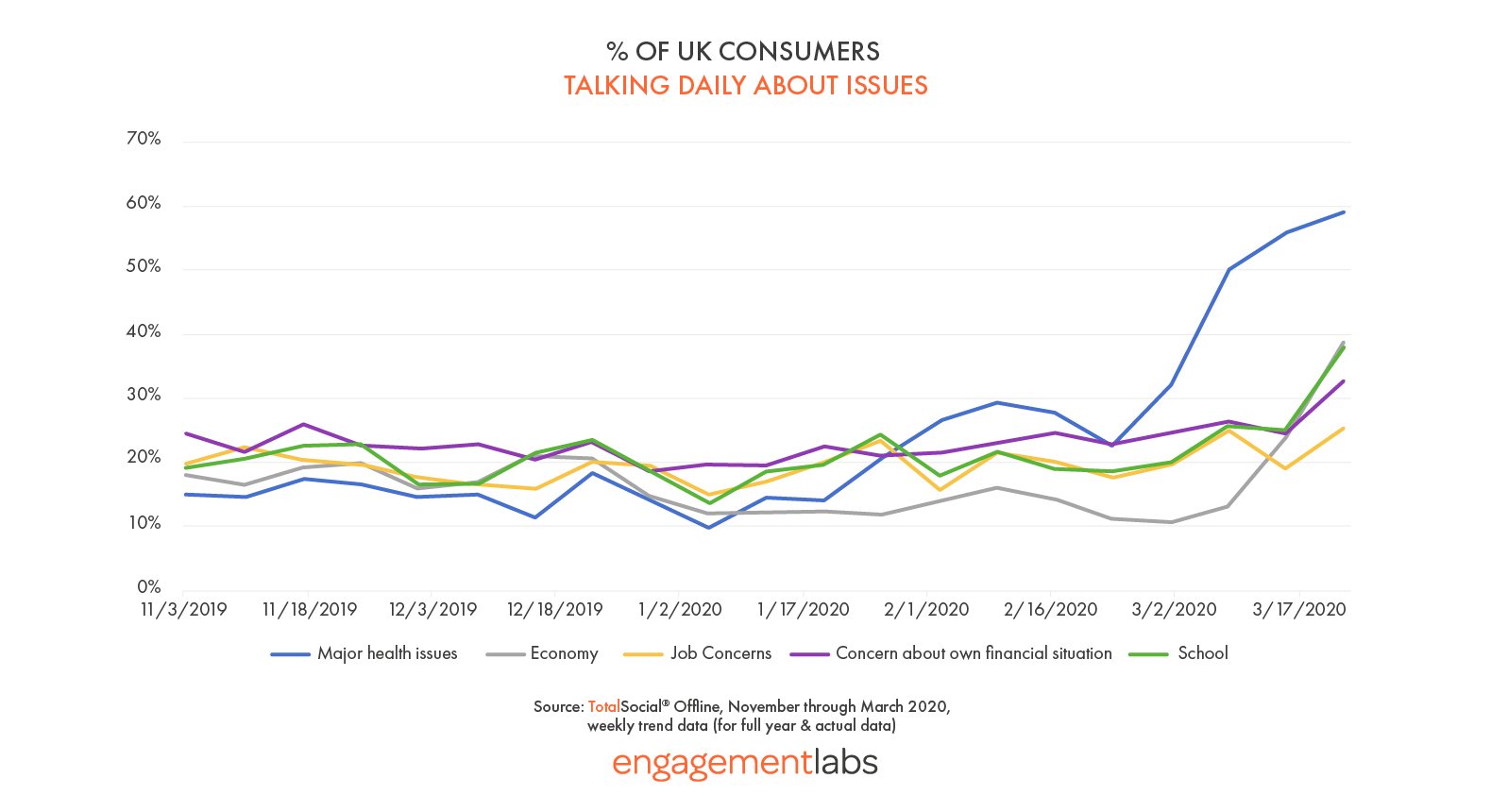

In the first of a series covering the impact and trends on UK consumer conversations during the ongoing outbreak of the coronavirus or COVID-19, dynamics on brand talk showed how it’s changing fast. Published a week ago, Engagement Labs reported that talk of “major health issues” climbed to 50% the week ending 8 March, 2020 during these unprecedented times, and we want to provide regular updates on data and insights to help marketers tackling tough decisions during this pandemic.

Our newest data show that consumers’ conversations in the UK continue to shift dramatically as more restrictions are put into place, including school closures.

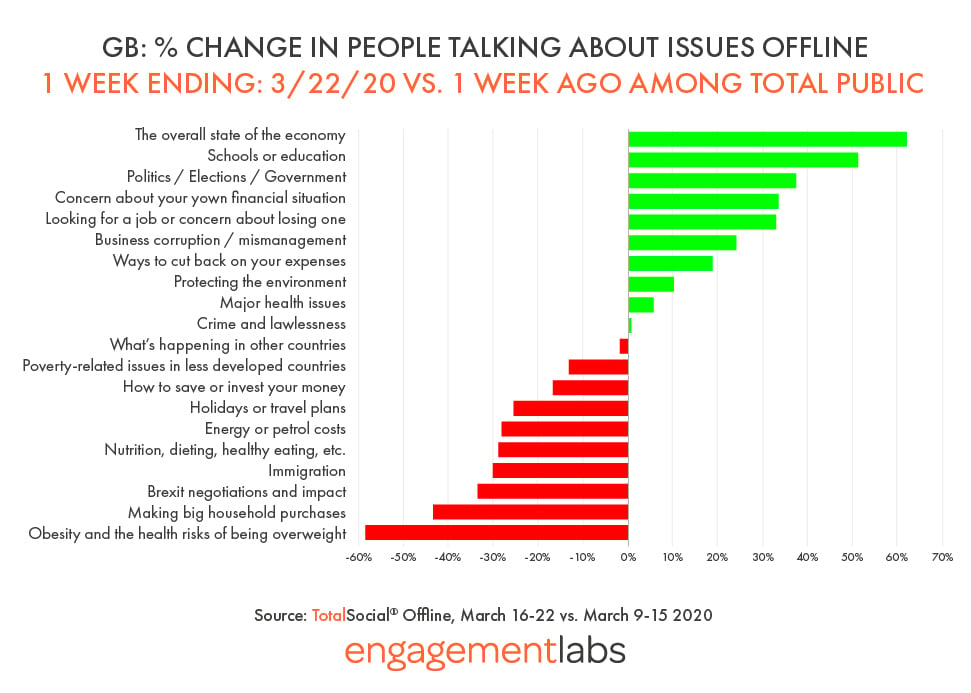

During the week ending 22 March, “Major health issues” continue to be first and foremost in consumers’ minds with 59% of consumers talking daily about the topic, representing a modest 5% increase from the week prior. At the same, discussions surrounding these additional topics surged among UK consumers: the economy (+62% change), schools (+51%), politics/government (+38%). The week also saw a rising number of consumers talking about concern about their own financial situation (+34%) and job concerns (33%). Just a week prior (week ending 15 March), the biggest “movers” in terms of issues included: the economy, what’s happening in other countries and energy/petrol costs, while personal concerns about finance and job security haven’t yet popped to the forefront of conversations.

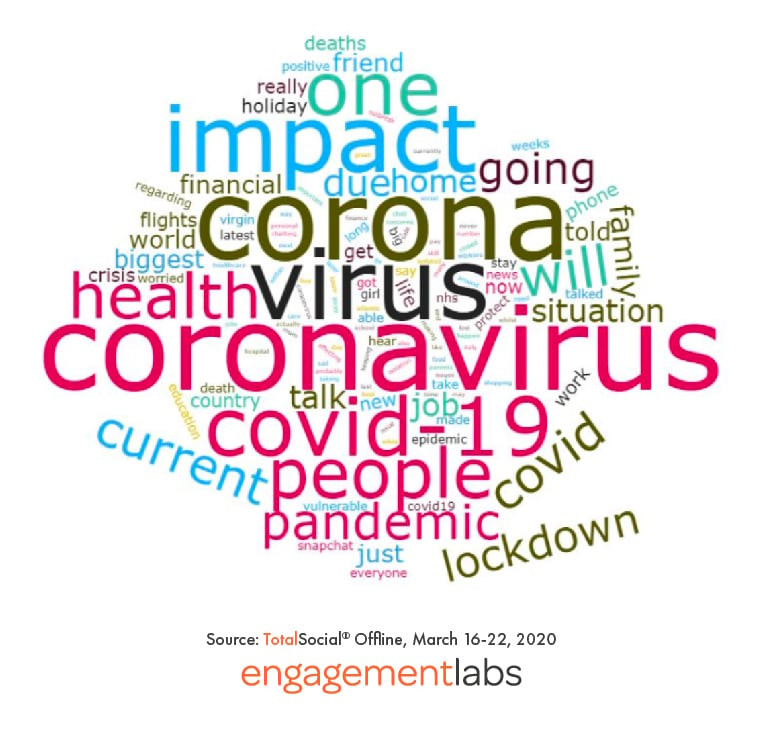

New to this week’s report, people tell us about their most impactful conversation of the past day. We can see clearly how much this virus specifically has impacted everyone’s day to day lives as it comprises just over half of the conversations that people tell us impact them the most. Additionally, 10% of discussions relate to schools/jobs/economy.

Words describing UK consumers “most impactful conversation” of the past day

The Evolving Brand Landscape

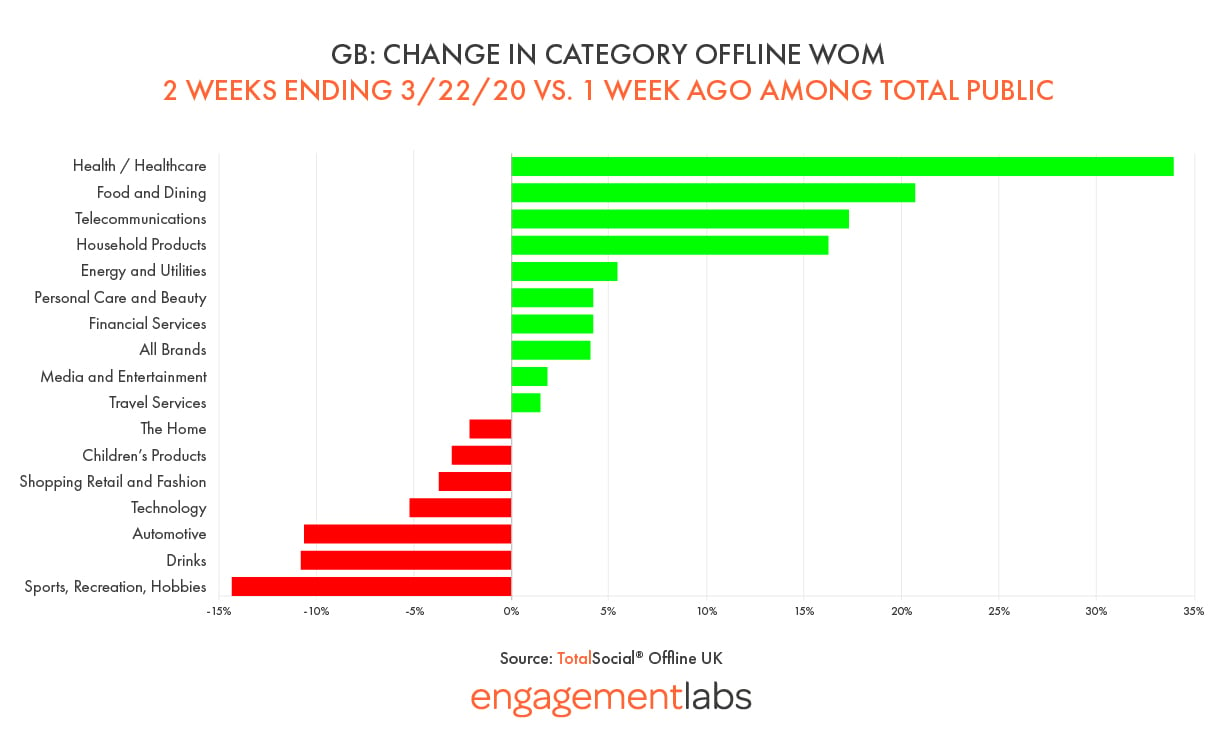

Consumers’ offline conversations about brands increased by 4% over the most recent two weeks (March 9 - 22) versus the two weeks ending March 15th.

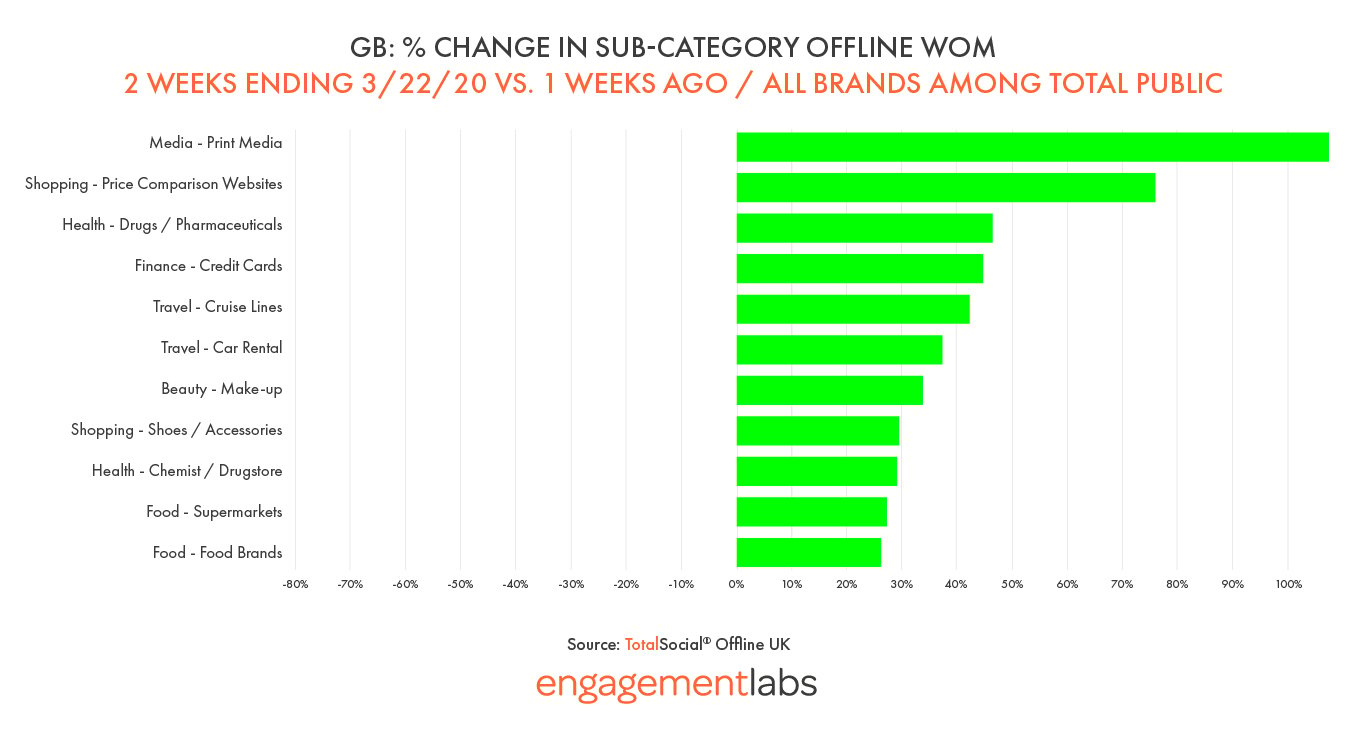

Categories with the biggest increases reflect the current “hunker down” mode: health/healthcare, food/dining, telecom and household products. Some of the sub-categories driving the most change include prescriptions (+47%), chemist (+29%), supermarkets (+28%), and food products (+27%). Other sub-categories such as print media (+108%), price comparison websites (76%) and credit cards (45%) also surged in recent weeks.

Looking at brands (see table below), the top 4 brands in terms of growth in offline conversation are Supermarkets: Tesco, Aldi, Sainsbury’s, and Morrisons, each with an additional 10 million or more word of mouth impressions now versus the prior period. Other essentials follow, such as Paracetamol, given the developments that this drug may be safer than ibuprofen. Sky, NHS, Boots, British Gas and O2 round out the top 10 list.

Next week we’ll see how UK Prime Minister Boris Johnson’s ordered lockdown and restrictions on 23 March affect the British consumer conversations.

If your company has a COVID team at work, and we can assist with unique data (offline as well as online social intelligence), or if you wish to discuss the impact of the coronavirus on your brand or your category, we invite you to reach out to us.

In the meanwhile, please keep safe and healthy!