Last week we shared our US coronavirus consumer conversation data series, with some eye popping results. This week the data are even more stark with important implications for marketers scrambling to make sense of it all and plan/act accordingly.

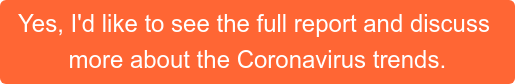

As the crisis surrounding the COVID-19 coronavirus pandemic deepens, “Major health issues” are the first and foremost in consumers’ minds with two-thirds of Americans talking daily about the topic. This is as expected and is followed by the President and how he’s doing his job (42% talking about this daily) and places to shop (40%).

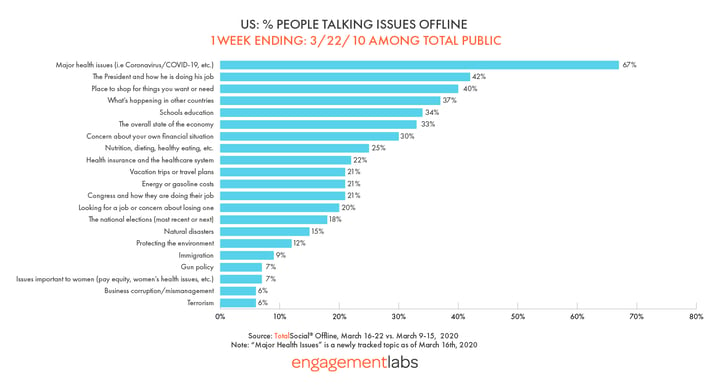

The pace of change is staggering. Americans’ conversations are shifting dramatically as a wider swath of the country “hunkers down” due to school closures, statewide shutdowns, and the economic toll becomes personal to many. Conversations also turned more political. During the week ending March 22nd, discussions surrounding these topics surged among Americans: schools (+65% change), Congress (+52%), gas costs (+46%), the economy (+41%) and the President (+25%). The week also saw a rising number of consumers talking about personal concerns related to their jobs (+29%) and their financial situation (+17%).

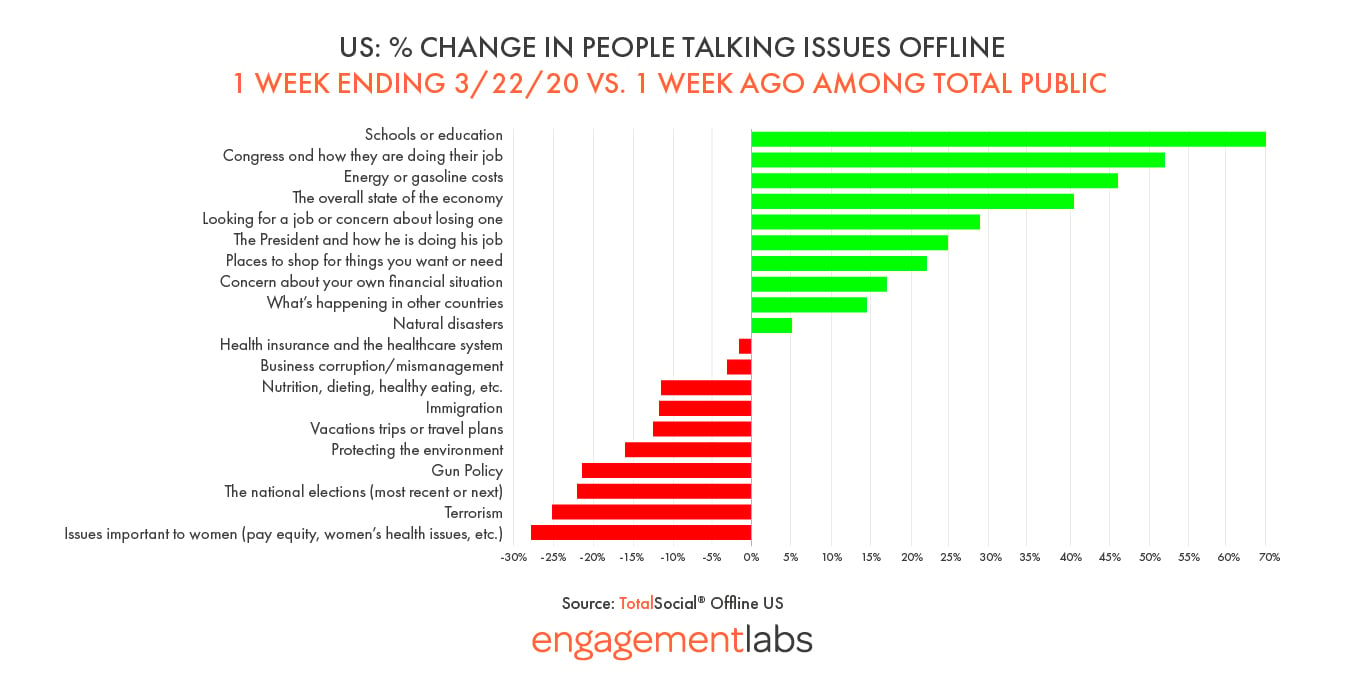

We can see clearly how much this virus has impacted everyone’s day to day lives as it comprises just over half of the conversations that people tell us impacted them the most. By way of comparison, 5% of impactful conversations related to schools and just 2% were political in nature (i.e. about Trump, congress, etc.).

Words describing Americans’ “most impactful conversation” of the past day

The Evolving Brand Landscape

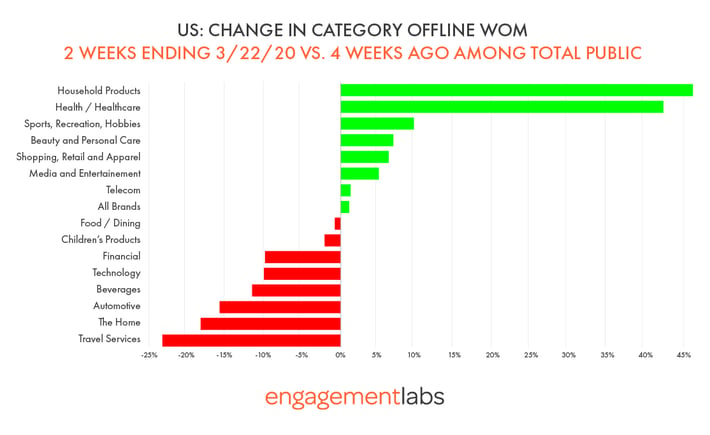

Categories with the biggest increases reflect the current “hunker down” mode: household products (+46% change), health/healthcare (+42%), sports (+10%), personal care (+7%), and shopping (+6%). Big ticket categories like travel (-23%), the home (-18%) and auto (-16%) declined sharply since a month ago, reflecting a combination of economic anxiety and an inability to travel or shop for these products.

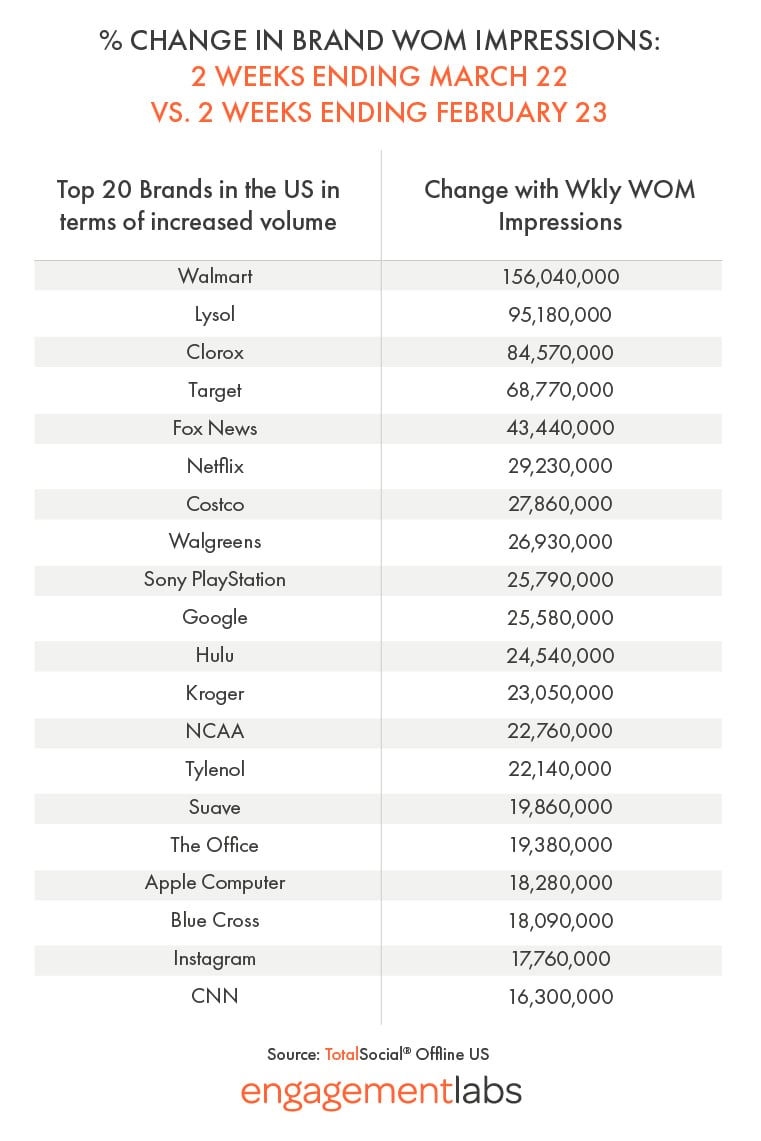

Looking at brands (see table below), 4 of the top 10 brands in terms of growth in offline conversation are retailers: Walmart, Target, Costco, and Walgreens, each with an additional 27 million or more word of mouth impressions now versus a month ago. Hard to find cleaning products, Lysol and Clorox, rank #2 and #3, respectively. Fox News jumped in the past couple weeks, as did sources of entertainment: Netflix and PlayStation. Lastly, it was interesting to see Google climb, driven by platforms enabling remote learning (i.e. Google Classroom) and working (i.e. Hangouts), as well as people’s general desire to search for answers to pressing problems.

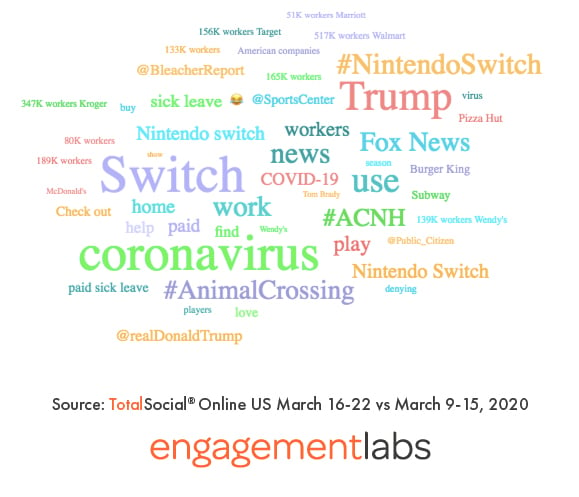

Looking at the content of social media conversations about the 600+ brands that are tracked in our TotalSocial platform, a week ago Coronavirus dominated everything else, with sports leagues following as seasons were halted. This week Coronavirus remains a top topic in those posts but is overtaken by Switch/Nintendo Switch (based on the power of its newly released Animal Crossing) and Fox News joining the top topics list.

As businesses and marketing professionals all face these challenging times of the Coronavirus, we will keep updating you on the rapidly changing landscape of American consumer conversations.

If your company has a COVID team at work, and we can assist with unique data (offline as well as online social intelligence), or if you wish to discuss the impact of the coronavirus on your brand or your category, we invite you to reach out to us.

Meanwhile, please stay safe and healthy!