How Can They Command Both Offline WOM and Social Media to Grow their Brands?

Insurance agents, financial advisors, and bankers all know how important word-of-mouth is to their success in the marketplace. Few consumers or investors are willing to put their financial futures in the hands of an agent or company not recommended by somebody they trust. It is the reason they put so much focus on customer referrals.

Yet financial brands perform poorly, as a rule, in our TotalSocial® analytics platform that measures conversation performance. The vast majority are what we call “Whisper Brands,” underperforming on both offline and online conversation.

Why does this matter? The clout of consumer conversation is real – and it is an imperative aspect of any marketing strategy today. Brands that achieve strong performance both offline and online are in an enviable position. Their ability to activate both offline and online engagement drives millions of dollars to their topline. One without the other will not drive brand performance as well, and one is not a surrogate for the other.

.jpg?width=709&name=020-10%20EL04%20FINANCIAL%20BLOG%20TALKSCAPE-01%20(2).jpg)

A reasonable number of financial brands, particularly investment brands such as Fidelity Investments, Edward Jones, and Charles Schwab are “Word of Mouth Mavens” performing above average in real-world offline conversations but not in social media. Just four brands including American Family, State Farm, Kaiser Permanente, and US Bank perform above average online but not offline, earning the label “Social Sirens.”

But the largest number of financial brands, 23 of 41 in our database, fall into the “Whisper Brand” category because they are below the average US brand both in social media and in real-world, offline conversations. Banks earn among the lowest scores, including BB&T and SunTrust (which merged to become Truist but for now each remain the brand name face to their customers), Citizens Bank, and TD Bank. But they have plenty of company from insurance, investment companies, and payment cards.

Why do financial companies, and especially banks, perform so badly in terms of consumer conversations?

One reason is that people don’t talk very often about financial companies, leading to low scores for volume. Brands in food, beverages, and entertainment benefit from the fact that they are relevant to everyone and represent daily conversations—what to have for lunch or dinner, or what to watch on television. But investment brands are likely to come up only when quarterly statements arrive or when there is a dramatic change in the stock market. Insurance companies may not come up in conversation until you need them—when you have a claim, or when you are buying a new car or home.

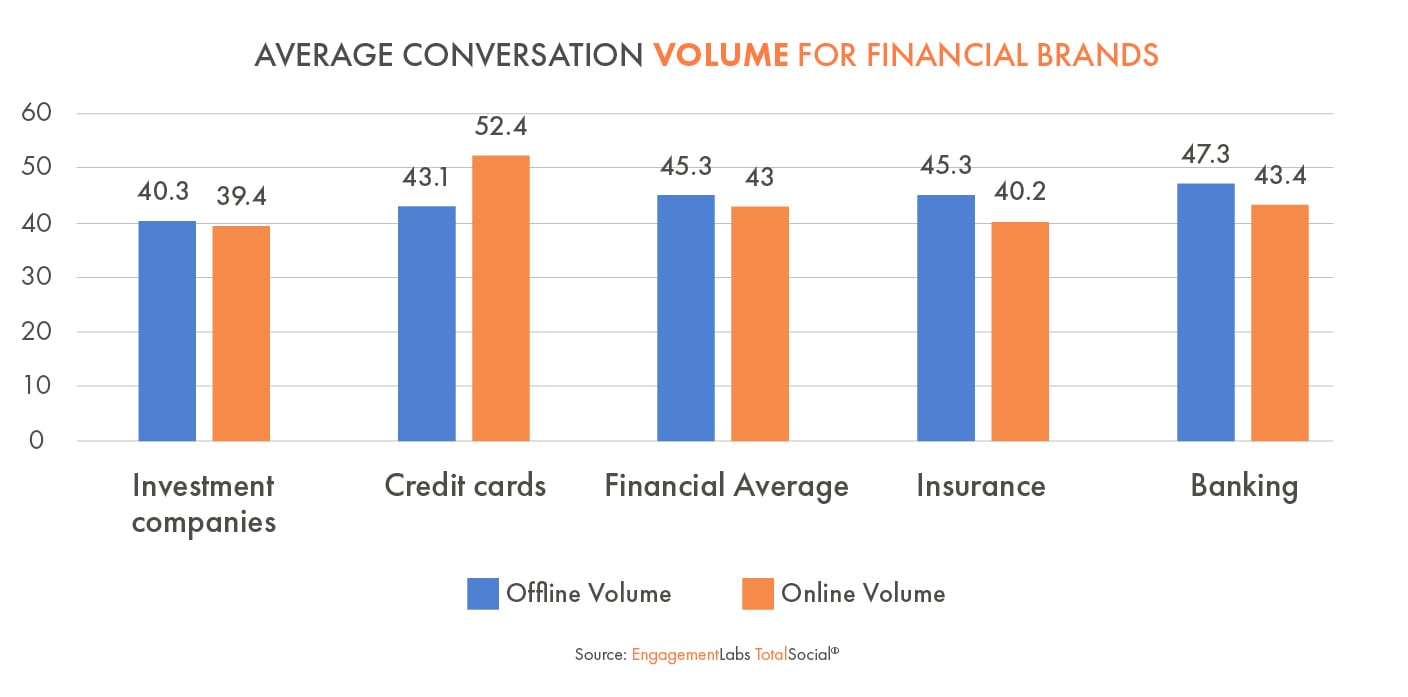

Thus, we find the average performance for brands in every type of financial institution is below average for offline conversation volume, and only credit cards perform above the average in social media. Investment companies—which are unlikely to be topics of conversations for people without investable assets—have the lowest performance, both online and offline.

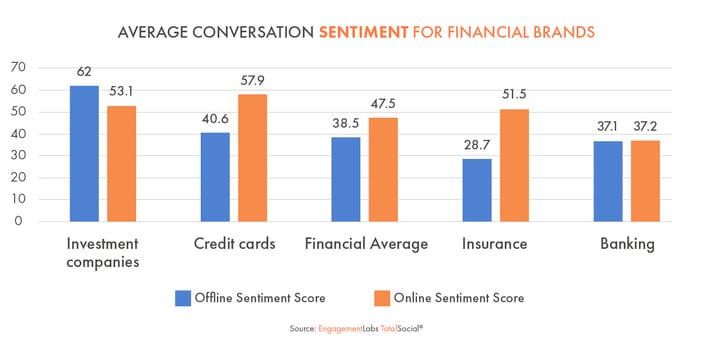

Another problem for financial companies is that they are generally unpopular, earning below-average sentiment score due to fairly high levels of negative conversations, particularly insurance companies and banks. Whereas investment companies perform poorly on volume, but they are strong performers on sentiment, especially offline, perhaps due to the fact that the stock market has held up fairly well, even during the pandemic. Credit card companies stand out for having the most positive conversations in social media.

Pathways for Financial Services Brands to Achieve Conversation Commander Status

Merely one financial brand, GEICO, qualifies as a “Conversation Commander” excelling at both online and in real-world offline conversations. Financial services is a real outlier compared to many other categories which have greater representation in this coveted quadrant. Give credit to the generous advertising budget of GEICO, which spent $1.6 billion in 2019, significantly more than the other big spenders in the property & casualty insurance category. The heavy advertising levels for all auto insurance companies like GEICO, Progressive and State Farm reflects the fundamental challenge of trying to be top of mind—and tip of tongue—when the category’s relevance to a consumer is infrequent.

GEICO’s paid media strategy helps the brand perform well above average for both offline and online brand sharing – when people talk about GEICO they talk about its media. This is a reflection of the size of their spend, to be sure. But it’s also about the creative, where GEICO is a strong performer with its Gekko but by no means is it alone. Progressive’s recent success was recently featured in the Wall Street Journal for its response to COVID-19 in an article entitled, “Coronavirus Upended Advertising. Here’s How Brands From Progressive Insurance to Budweiser Responded.”

A more modest investment in social media content is also a highly effective way to move a brand from being a Whisper Brand to a Social Siren. That’s what State Farm has done, at half the ad spend level of GEICO. Much smaller brands can achieve Social Siren success as well by learning the lessons for driving sharing of social content. What prevents State Farm from being a Conversation Commander is it’s offline sentiment, which trails the category average by a fair degree.

Several brands perform very well among offline influencers – people who are sought out for advice and recommendations and whose advice is trusted and acted upon. Financial brands that do particularly well with influentials are Progressive, Citi, GEICO, TD Ameritrade, American Express, Edward Jones, and Regions Bank. In a category like financial services, that’s a key audience to identify, engage with and let them become your advocates. A tactic we’ve seen work well for driving offline conversation is to enlist your most socially-connected customers into a VIP community that can help distribute your news and content, both online and offline. These influentials are a real asset to call upon.

Fidelity, TD Ameritrade and American Express are examples of brands we call “WOM Mavens,” strong performers offline but are merely average online. Fidelity, for example, has the highest offline TotalSocial score of any financial services brand. However, its online volume is below the category average as is its performance in sharing of its social content. American Express, as stated above is a strong performer among offline influencers, but its online influence performance is among the lowest in the category.

There’s no question that financial brands are at a disadvantage in the word-of-mouth game, but category is not destiny. Consumers are hungry for advice from trusted friends before making big-ticket, long-term financial decisions. That’s why it pays to make a plan that puts your financial brand at the center of the conversation.