In this weekly update, we see important shifts in the UK’s consumer conversation, which are often a predictor of future behavioural shifts. There is less focus on hot topics/issues as well as a shift in people’s most impactful conversation of the day. That is coupled with important changes in the emotions associated with that conversation. This change signals the continuing evolution of the UK consumer’s response and reaction to the pandemic and the ways they are adapting to this “new normal.”

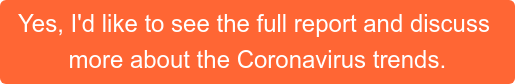

Issues becoming less prevalent in consumers day-to-day discussions

As consumers become immersed in their new way of life, we are seeing a drop-off in discussions about most major issues. In fact, apart from obesity and crime and lawlessness, all other topics either declined or remained on-par with the prior week.

Consumers’ most impactful conversation shows a decline in Coronavirus talk, more happiness echoed in conversations as family surges

The Coronavirus pandemic continues to be at the forefront of consumers’ most impactful conversation of their day. However, we are seeing Coronavirus decline as each week goes on (46% week-ending 12th of April vs. 50% w/e 5th April and 60% w/e 29 March). We see the inclusion of “Family and Friends” as a bigger topic last week (15%, +7 pts from prior week).

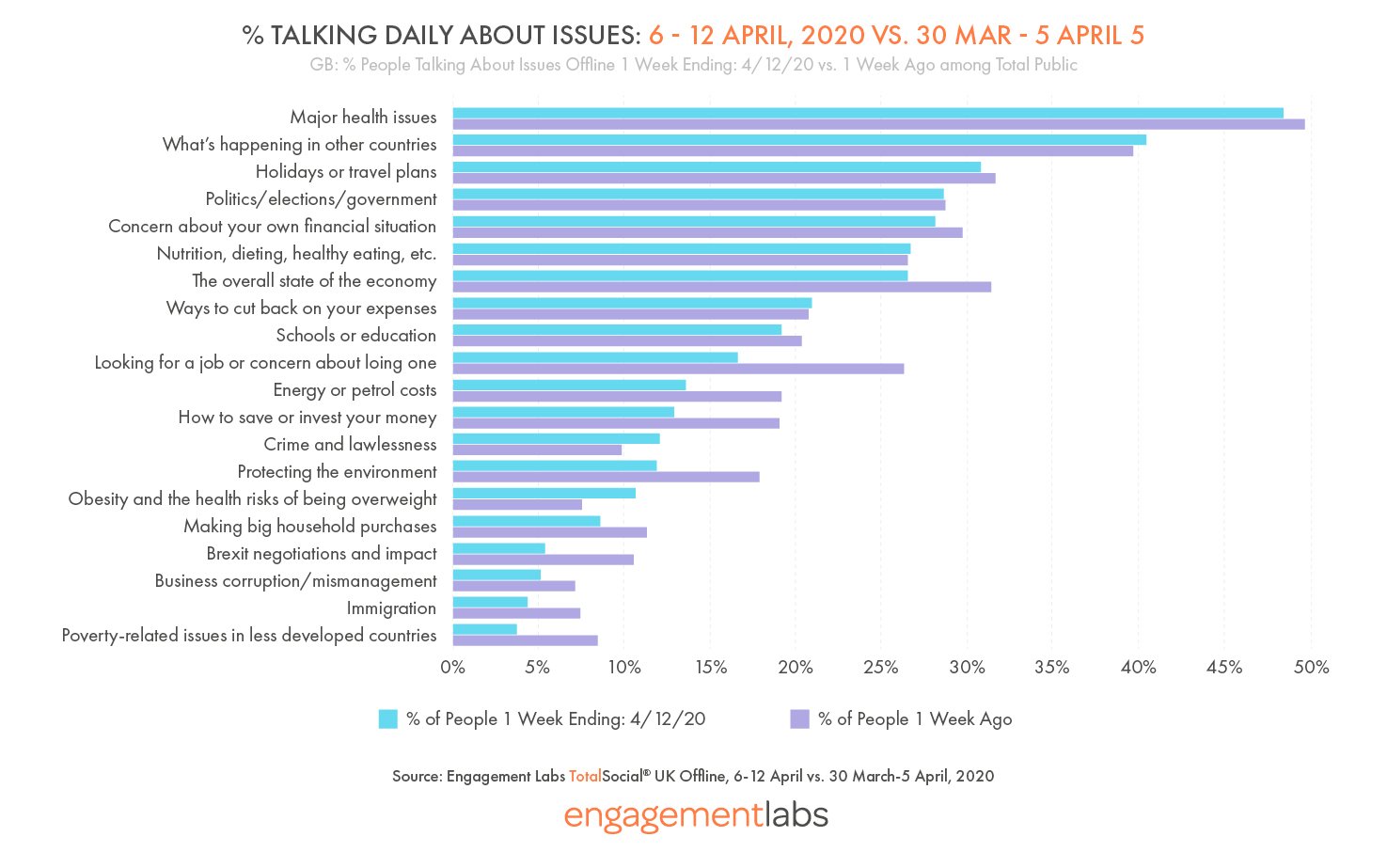

After respondents tell us about their most impactful conversation, we ask them to tell us how they felt during that discussion using a spectrum of common emojis. These data offered several insights this past week.

- Boost in consumers reporting their impactful conversations left them with a “grinning smiley” face (17%, +7 pts.).

- Boost in more joyful discussions coincides with a drop in “crying” (25%, -3 pts.) and “screaming in fear” (6%, -3 pts.).

- When consumers do talk about Coronavirus/Covid-19 as their most impactful conversation, the thoughtfulness emoji increased since prior weeks, while anger declined. When you look at impactful conversations that are not related to Coronavirus/Covid-19, smiley faces are among the most frequently selected emotions.

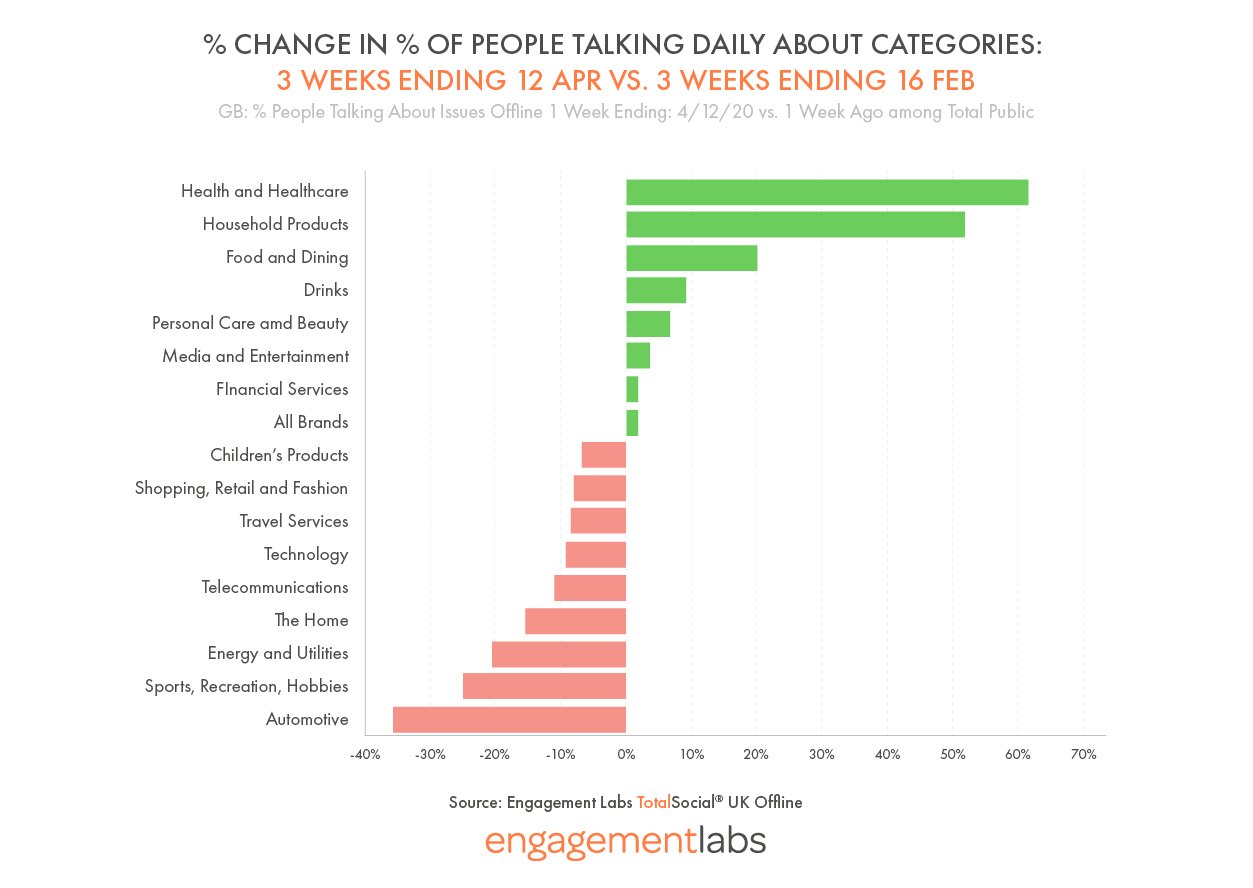

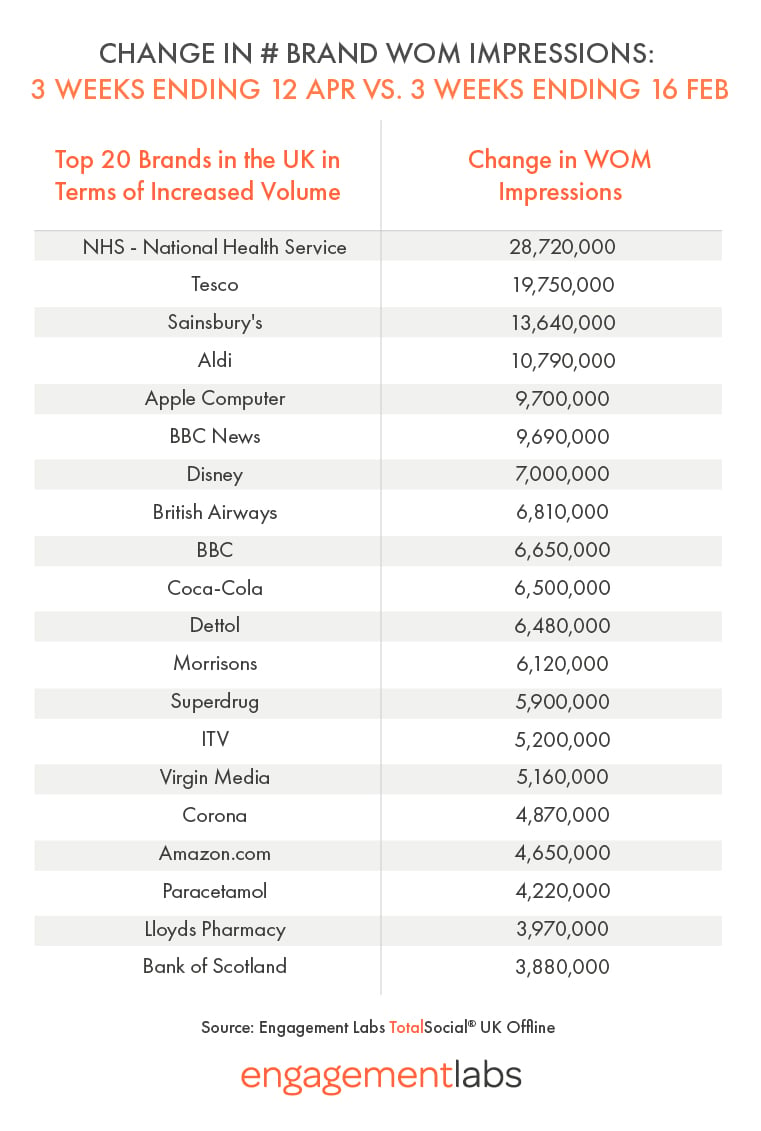

The brand landscape evolved dramatically since February

Across all categories, consumers in the UK are talking about slightly more brands (+2%). The surge in conversation level for need-based categories (i.e. FMCG), was offset by the steep declines seen for big ticket brands (i.e. auto) and categories negatively impacted by Covid-19 (i.e. travel).

- Not surprisingly, health/healthcare discussions increased significantly (+62%).

- Need-oriented consumer packaged goods surged: household products (52%), food (20%), drinks (9%) & personal care (7%).

- Media and entertainment increased somewhat (4%), as consumers pass their time at home watching more TV programmes, trying out more streaming services/networks, and catching up on movies.

- Big ticket categories such as auto (-36%), home (-15%) and tech (-9%) fell since the pre-Covid-19 period.

Established service needs such as telecom (-11%) and energy (-21%) fell, but finance remains stable (+2%).

Four brands have by far the overall largest gains in offline volume: NHS (+29 million weekly WOM impressions), as well as supermarkets, Tesco (+20M), Sainsbury’s (+14M), and Aldi (+11M). Apple, BBC News, Disney, BA, BBC, and Coke round out the top 10 each with over 6.5M additional weekly WOM impressions.

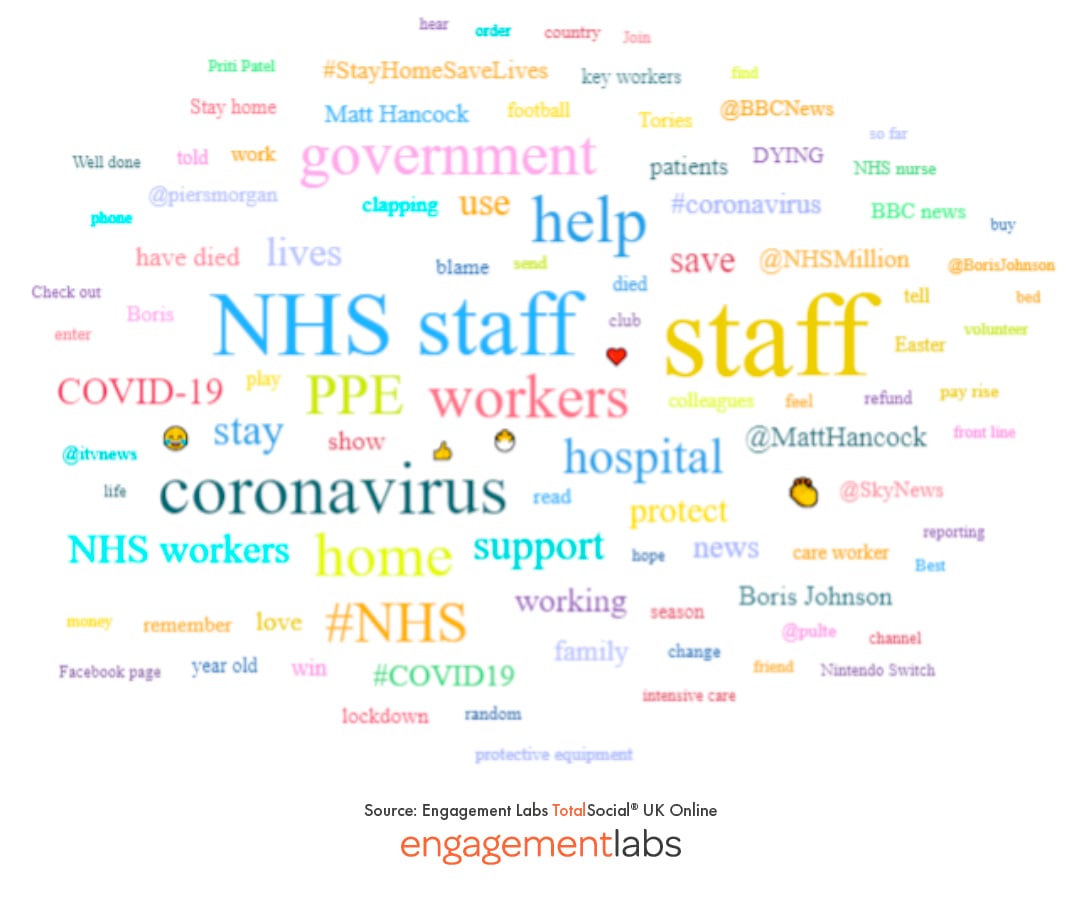

Admiration and concern for frontline workers favors online conversations; coronavirus itself is just a secondary topic

In addition to offline conversations, Engagement Labs also explores social media conversations about 350+ leading brands in the UK. When you explore topics of online conversations about these brands, we see talk surrounding frontline workers (NHS staff, hospital, workers, #stayhomesavelives, etc.) led the charge last week. Coronavirus and Covid-19 surfaced, but only as a secondary topic.

We will continue to update you on the impact of COVID-19 on Britain, and in the meanwhile we encourage you to contact us with any questions or if we can be of further assistance.

If your company has a COVID team at work, and we can assist with unique data (offline as well as online social intelligence), or if you wish to discuss the impact of the coronavirus on your brand or your category, we invite you to reach out to us.

In the meantime, stay safe and healthy!