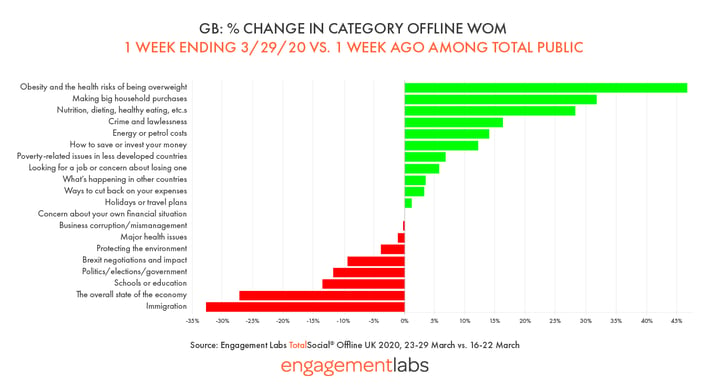

With more folks staying indoors and social distancing measures implemented, our latest Coronavirus data report shows that consumers’ conversations in the UK continue to shift as they grow accustomed to the new normal. Health issues remain the top concern by a wide margin, with 58% of Britons talking daily about it. This week, a widening set of conversation topics have entered British households.

If you missed last week's report, please do check out last week’s blog to compare the progression of our findings. Much has happened since.

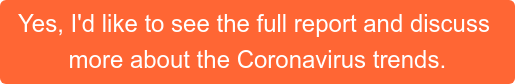

During the week ending 29 March, discussions surrounding these topics increased among UK consumers: obesity & health risks of being overweight (+47%), making big household purchases (+32%) and nutrition and healthy eating (+28%).

In the UK Coronavirus trend blog series, we saw financial issues such as the economy, concerns about personal finances and job insecurity tick up, along with schooling. While these issues didn’t continue their dramatic uptick, it is still important to note that they remain front and center in consumers’ minds with more than 1-in-4 talking daily about the economy and job concerns, and 1-in-3 discussing concern about their personal finances.

Change in Topics Discussed Since Prior Week

% Talking Daily About Issues: 23-29 March, 2020

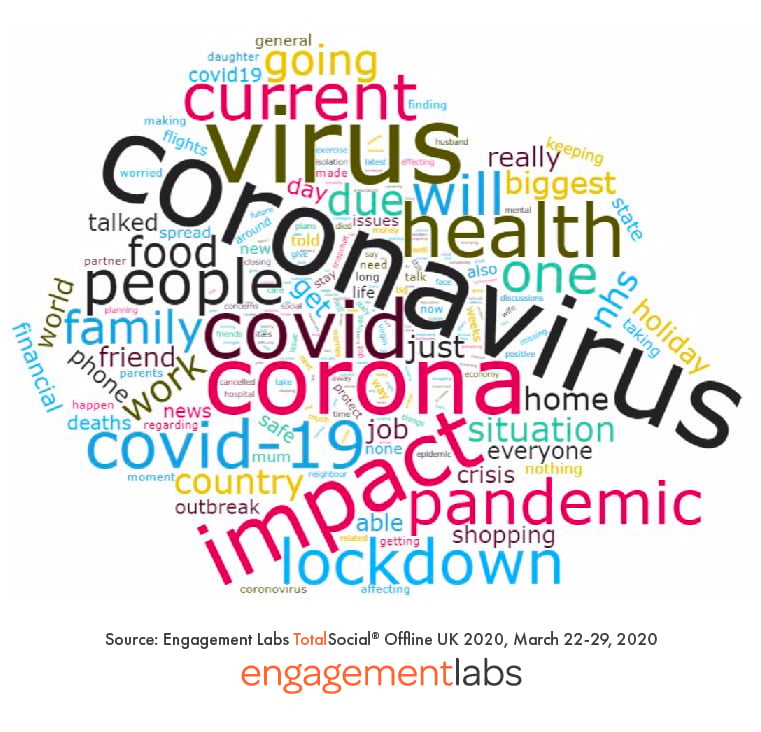

The impact of Coronavirus continues to dominate consumers’ most impactful conversation of the past day. Talk about the virus specifically comprises 60% of the conversations that people tell us impact them the most. When asked what emoji best describes how people felt during these Coronavirus conversations, the crying emoji was selected most (29%), followed by screaming in fear (17%), neutral (16%) and nervous (14%) emojis.

Words describing UK consumers “most impactful conversation” of the past day

The Evolving Brand Landscape

As brands and businesses shift budgets during these uncertain times, Engagement Labs provides valuable and unique conversation data for marketers that help point marketers plott a strategic route and what you should consider. We realize that the campaigns that were worked on for months may no longer be relevant or appropriate during this crisis.

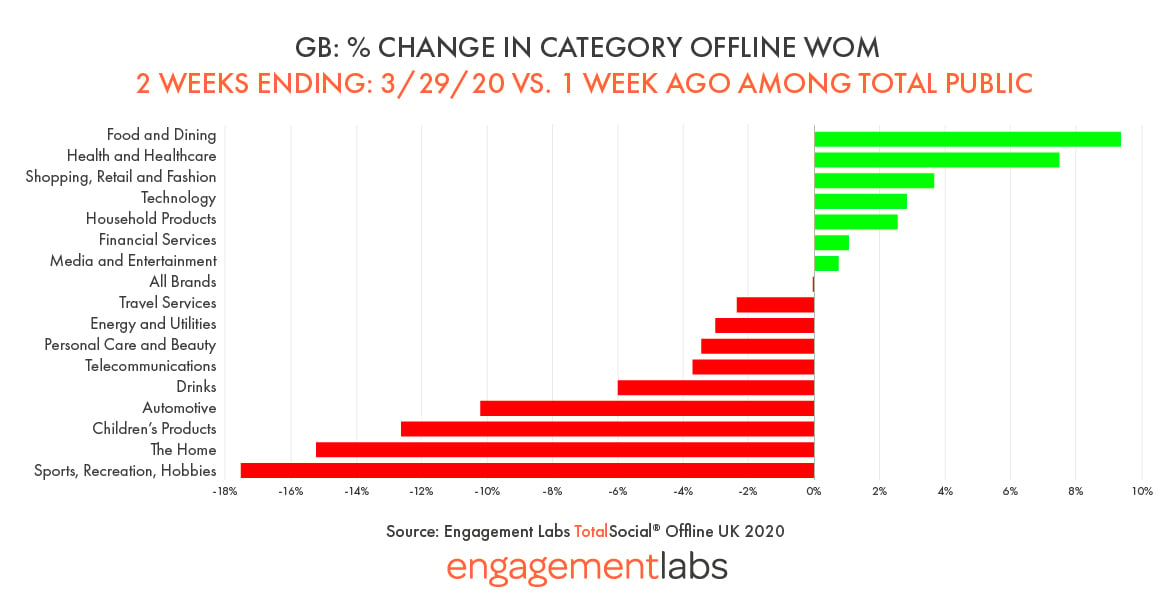

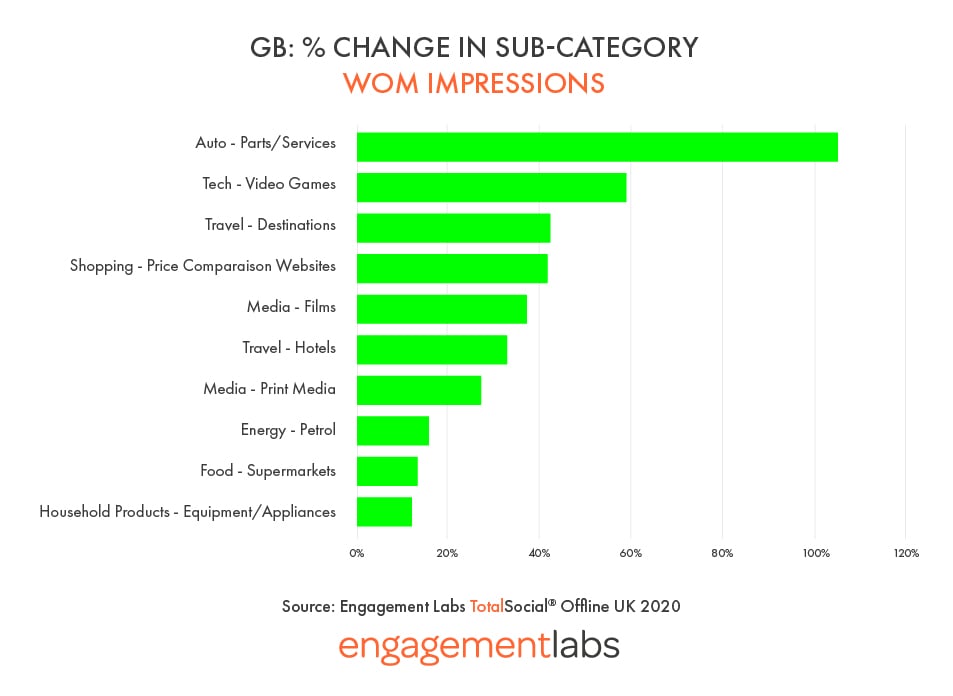

In a time of great uncertainty, our data shows that while there was little movement in volume of brands discussed since the prior two weeks, there were shifts in categories discussed. Categories with the biggest increases reflect the current “hunker down” mode: food, health, shopping, tech and household products. Some of the sub-categories driving the most change include auto parts (+105%), video games (+59%), destinations/cities (+42%), price comparison websites (+42%), films (+37%), hotels (+33%), print media (+27%), petrol (+16%), supermarkets (+14%) & household appliances (+12%).

Looking at brands (see table below), 6 of the top 20 brands in terms of growth in offline conversation are Supermarkets: Tesco, Asda, Sainsbury’s, The Co-Op, Aldi and Ocado. Other essentials fill the top list, such as the NHS, Bank of Scotland and Asda Petrol. Media/entertainment brands are also a rising part of British talk, with, including Amazon Prime, BBC, BBC News and the TV programme Coronation Street.

% Change in % of People Talking Daily About Categories: 2 Weeks Ending Mar 29 vs. 2 Weeks Ending Mar 22

% Change in % of People Talking Daily About Sub-Categories: 2 Weeks Ending Mar 29 vs. 2 Weeks Ending Mar 22

We will continue to update you on the impact of COVID-19 on Britain, and in the meanwhile we encourage you to contact us with any questions or if we can be of further assistance.

If your company has a COVID team at work, and we can assist with unique data (offline as well as online social intelligence), or if you wish to discuss the impact of the coronavirus on your brand or your category, we invite you to reach out to us.

In the meantime, stay safe and healthy!