Welcome to week 6 of Engagement Labs weekly tracking of Coronavirus and its impact on UK consumer conversation. In the week 5 update, we saw more positive discussions in the UK – less issues discussed and more “happiness” in consumers’ impactful discussions. In this update, we are seeing conversations bounce back to more pressing issues, in particular financial – both macro and personal – as well as talk about education/schools. We are also seeing an interesting shift in how consumers are talking about brands – less face-to-face conversations, which is not surprising – and more phone calls (voice and video chat). Despite this changing trend, it is heartening for marketers to see that consumers are keeping up with just how many brands they talk about.

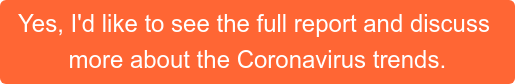

As consumers in Britain settled into lockdown with their immediate family or alone, it is not surprising that the proportion of face-to-face conversations declined (currently at 61%, -15 pts from February). However, what’s interesting is how these conversations shifted. Most importantly, we see that consumers are turning to phone/voice calls (18%, +6) and video calls (6%, N/A*) to fill the gap in face-to-face conversations. And while we are seeing a 4-point increase in social media conversations (6%), other “online” formats (email, IM and text) are relatively unchanged.

Despite the proportional decline in face-to-face conversations, we are seeing the same number of brands discussed since a year ago. In fact, brand volume across all categories has been somewhat elevated since March, only just now starting to taper off to become on par with what we saw a year ago. This suggests that brands continue to remain a big and important piece of consumers’ daily conversations, despite the massive disruptions that Coronavirus has had on consumers’ lives.

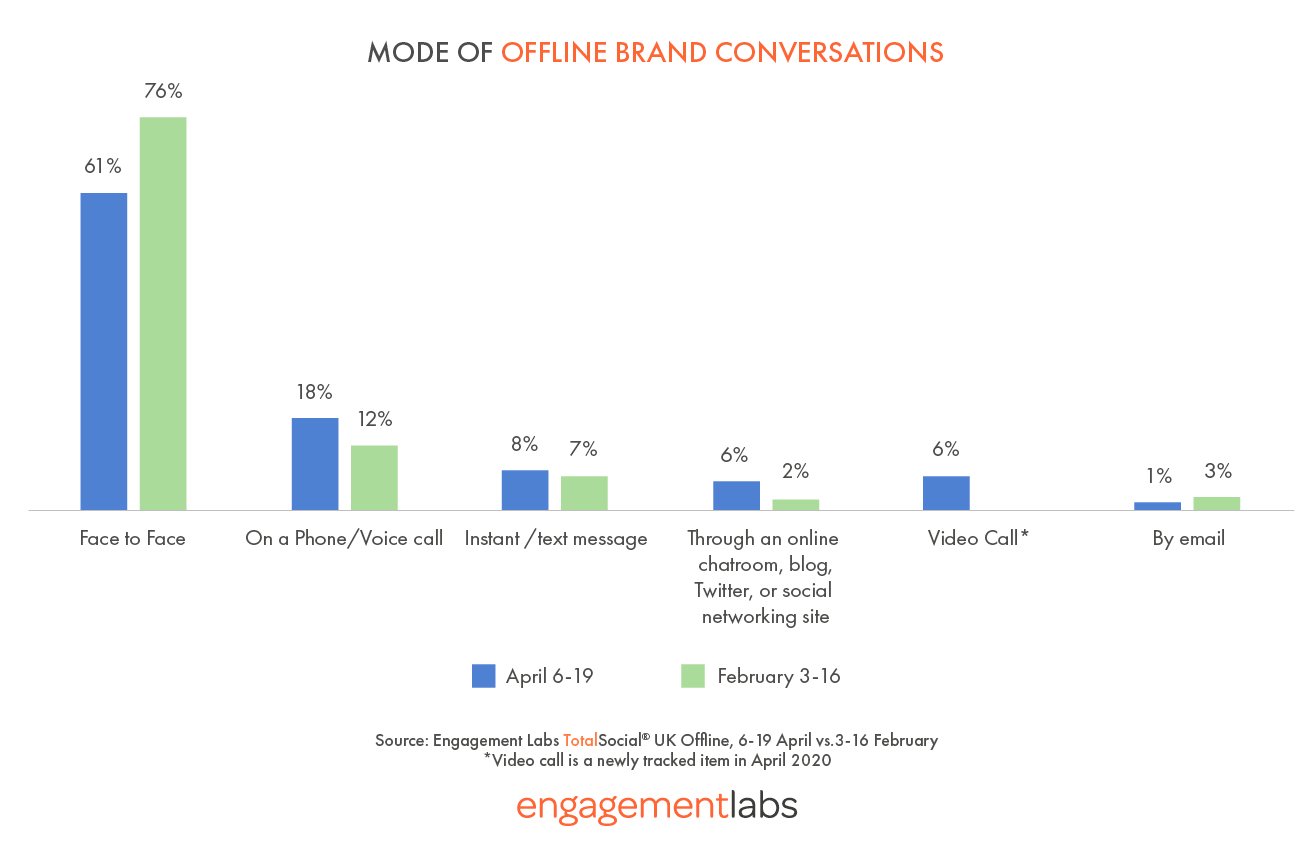

Schools and financial ramifications of Coronavirus – at a macro and personal level – surge in last week’s conversations

Since the previous update (week-ending April 12th), consumers started talking more about economic ramifications of Coronavirus. This includes consumers engaging in more discussions about the economy in general (34%, +8 points) as well as actions to take to be more secure saving/investing your money (18%, +5). Job concerns also rose last week (22%, +5) as did discussions about schools/education as uncertainty about a potential start date abounds (28%, +9). As the table below shows, increased engagement in these four issues cut across nearly all demographics.

% Talking Daily About Issues: 13 - 19 April

Coronavirus continues to fall as consumers most “impactful” discussion, financial/job and family discussions are filling the gap

During the week of 13th to 19th of April, many consumers continued to describe their most impactful conversation as related to Coronavirus/Covid-19 (40%), however, as the bar chart below shows, this figure has fallen as each week goes on. What impactful topics are taking the place of Coronavirus? For one, more consumers are reporting financial/job-oriented discussions as being their most impactful (13%, +4 pts from prior weeks). Additionally, family/friends continue to colour impactful conversations although at a slightly lower level than seen the first week of Easter Holidays (13%, -2pts from week ending April 12th).

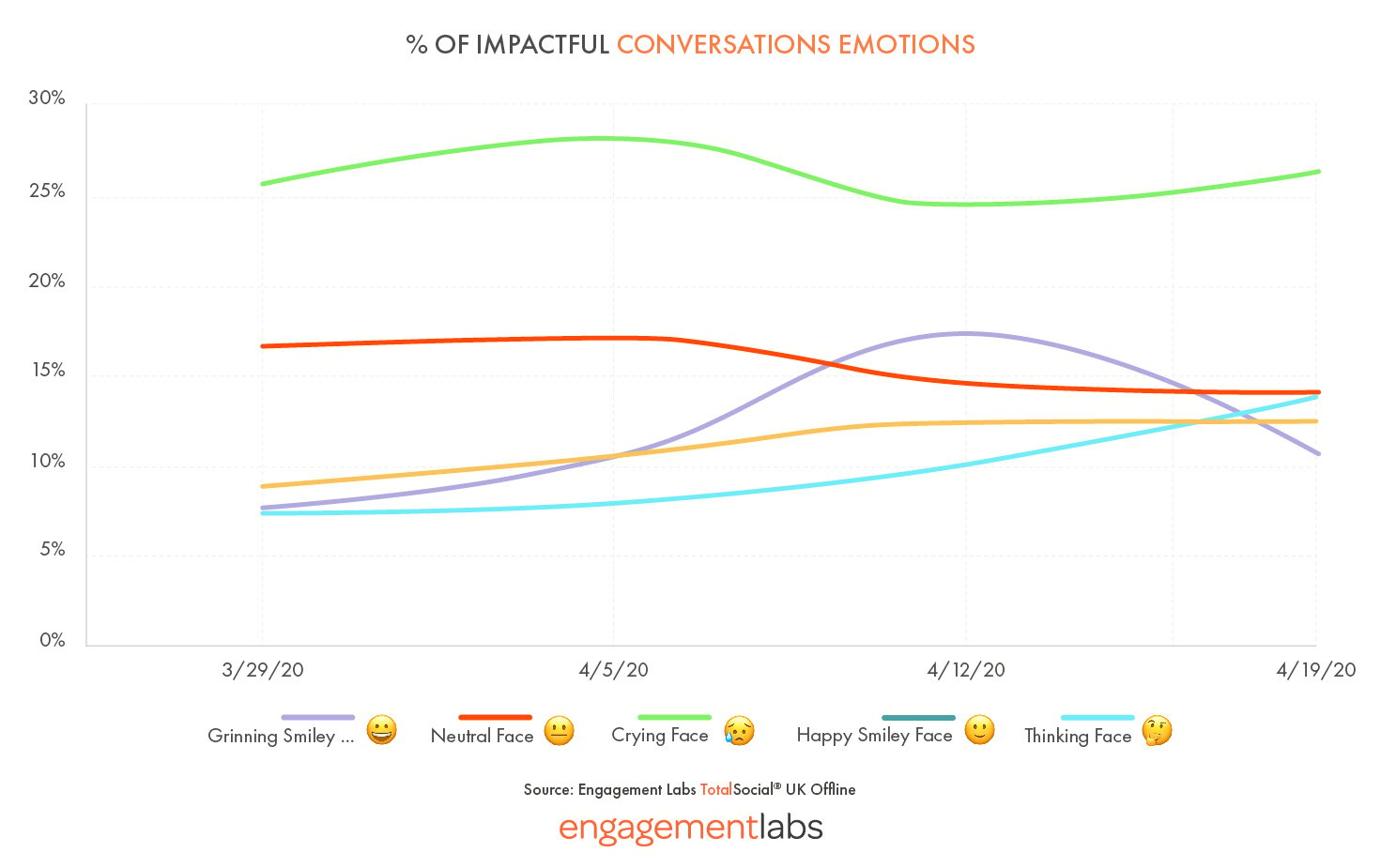

While over one-quarter of consumers continue to depict their most impactful conversations in general with a “crying face,” it is nice to see the “happy face” rise to 14% (+6 points since week-ending April 5th).

Emotions felt in “Most Impactful” Conversation: Top 5 shown, by Week

We will continue to update you on the impact of COVID-19 on Britain, and in the meanwhile we encourage you to contact us with any questions or if we can be of further assistance.

If your company has a COVID team at work, and we can assist with unique data (offline as well as online social intelligence), or if you wish to discuss the impact of the coronavirus on your brand or your category, we invite you to reach out to us.

In the meantime, stay safe and healthy!