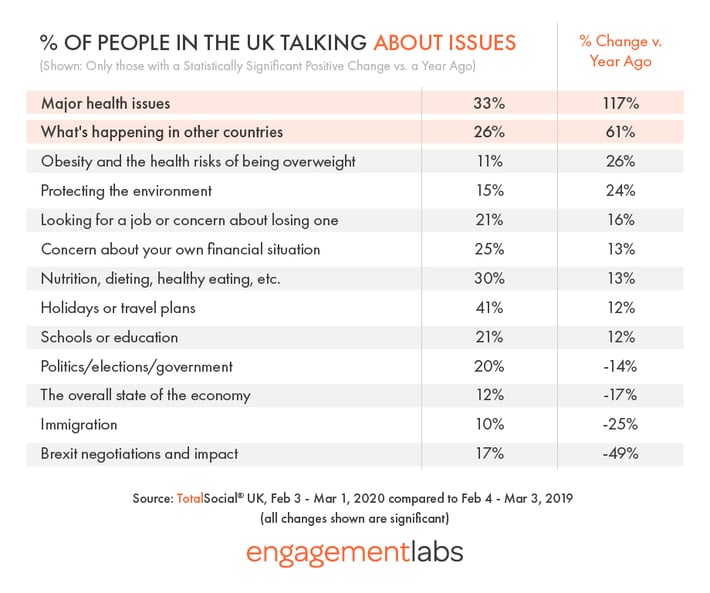

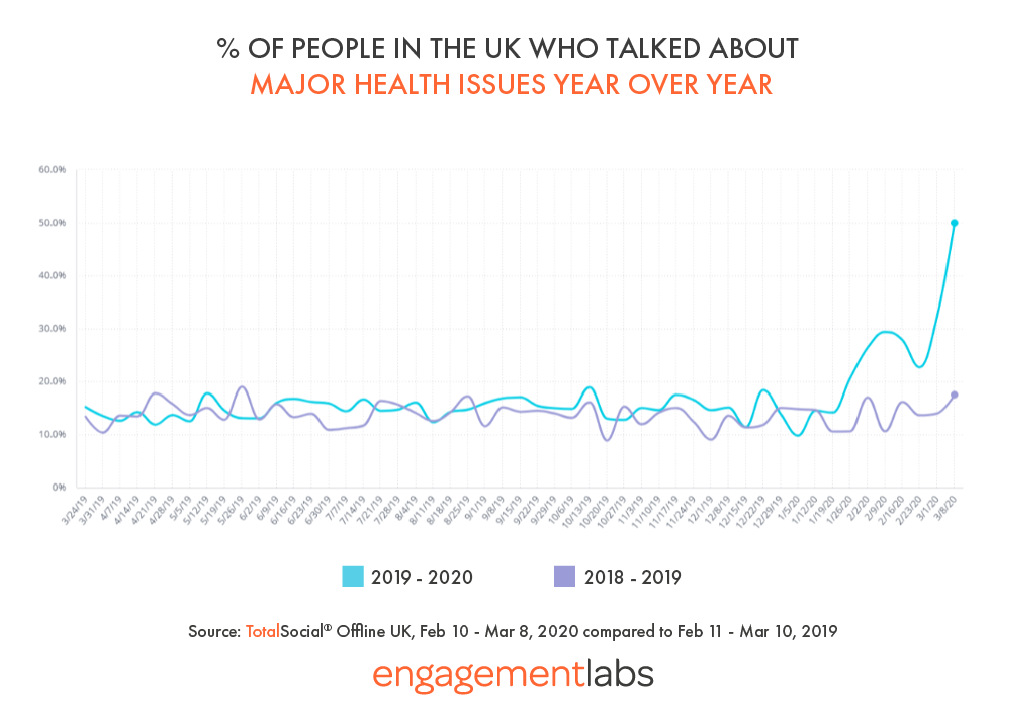

With the COVID-19 Coronavirus pandemic causing widespread anxiety and disruption, the impact in consumer conversations in the UK has begun with fully 33% of consumers ages 16-69 are discussing “major health issues” on a daily basis - double what was seen a year ago, and 18% greater than what Engagement Labs saw last week. On a weekly basis, talk of “major health issues” climbed to 50% the week ending 8 March, 2020.

During 4-weeks ending 8 March, over one-in-four people talked about what’s happening in other countries, a 61% increase. Talk of “holidays or travel plans” and “schools or education” increased by 12%. The increase in “holidays and travel plans” reflects the surge in people having to make decisions to cancel/postpone travel in recent weeks.

According to our ongoing TotalSocial tracking study, based on our survey of over 2500 consumers, on average, of the UK market questioned between 10 February and 10 March 2020. On a trended basis, we see the lift in discussions about “major health issues” climb dramatically in the past three weeks, particularly the week ending 8 March, as seen in the image below.

Chart: % People Talking Daily about “Major Health Issues” on a Weekly Basis (Blue Trend = 2019-20; Purple Trend = 2018-19)

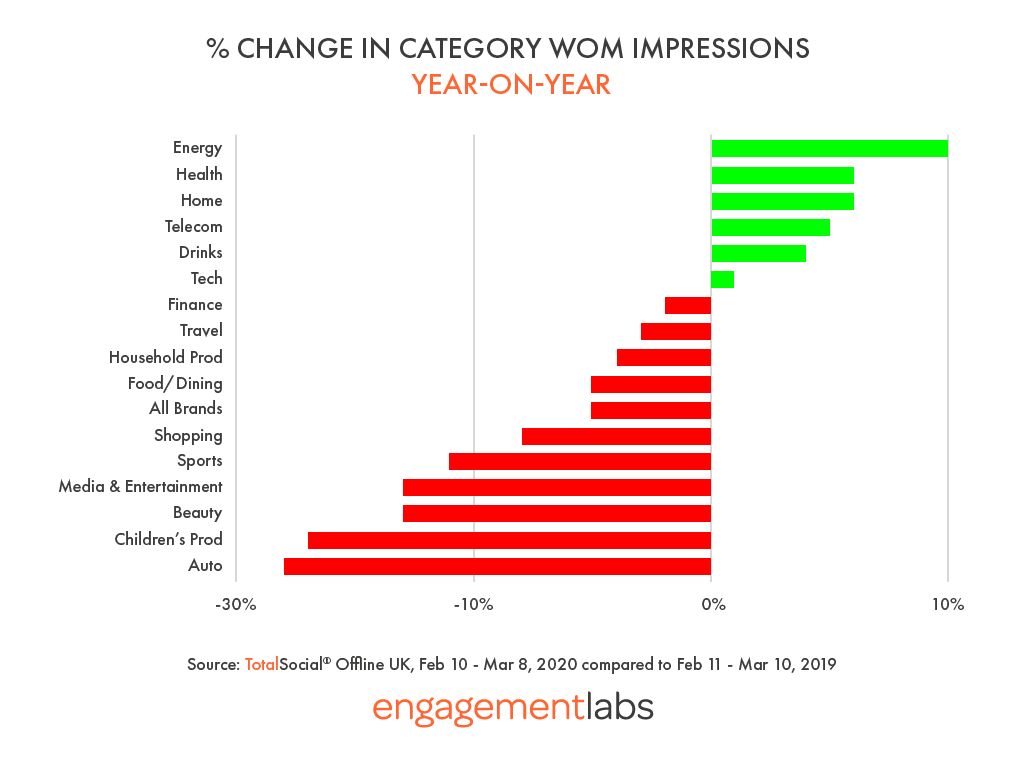

While the above findings focus on issues discussed, it is also important for brand marketers to understand how conversations about categories and brands are shifting in the UK. Below are some of the most important shifts we are seeing:

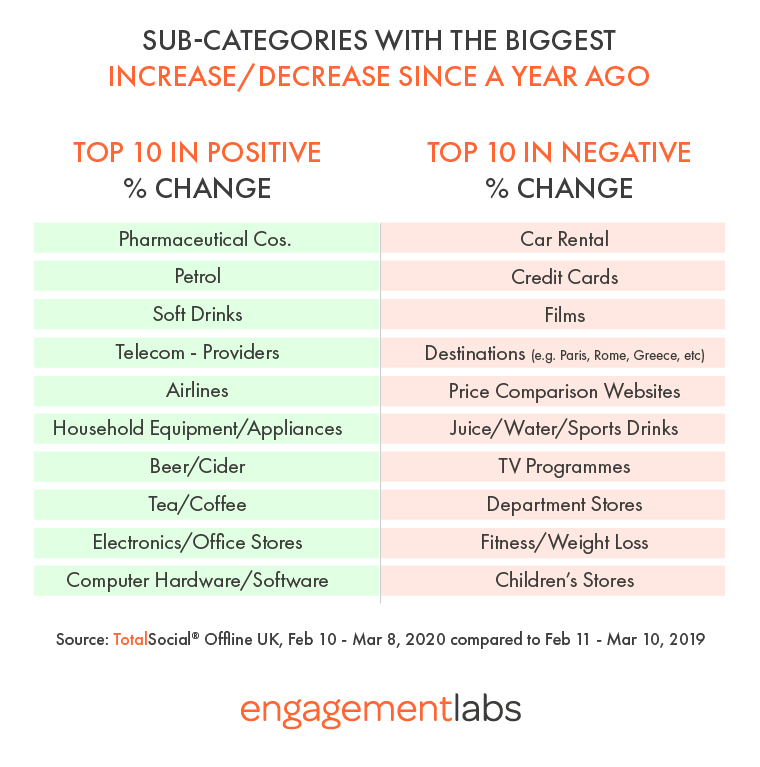

- The categories with the biggest decline in offline word of mouth include Auto, Children’s Products, Beauty, Media & Entertainment, Sports, and Shopping.

- The sub-categories declining (vs. same time a year ago) include: Car Rentals, Credit Cards, Films, Destinations, and Comparison Shopping Websites.

- While many sub-categories declined, some experienced a sizable increase in conversations, including: Pharmaceutical Companies, Petrol, Soft Drinks, Telecom Providers, and Airlines.

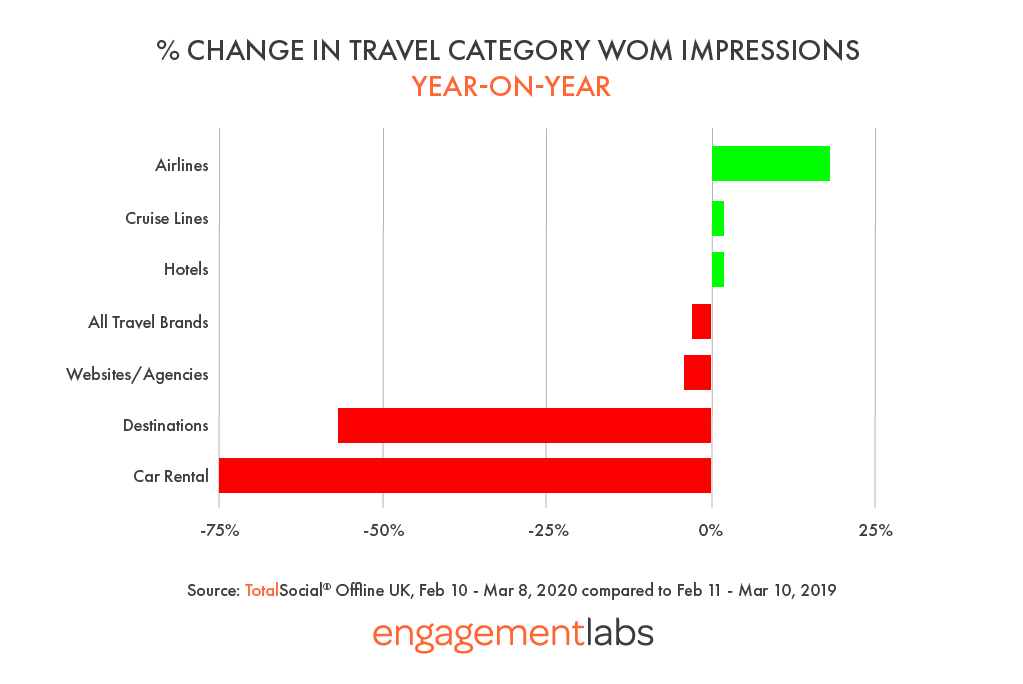

- With all the news of limiting travel in Europe, we were surprised to see the overall Travel Category relatively flat compared to last year, but when we look into it, most types of travel brands are being talked about less (destinations, car rentals and website services), while Hotels and Cruise lines are flat. The only sub-category within travel to surge is Airlines, almost certain a result of massive flight cancellations, international travel bans and restrictions and subsequent talk of financial trouble within the airline industry. We expect conversations about Airlines may continue to increase over the next week, but we anticipate they will then start to fall as more measures are put in place for those in the UK to limit social contact.

We’ll continue to monitor these trends as the situation develops.