As July comes to an end, retailers and e-commerce continue to push through and find themselves amidst a fervent battleground, seizing every opportunity to vie for consumer attention and market share. In this context, this article will introduce the top 10 retail rankers overall TotalSocial, offline and online lists. With the pinnacle of the month being Amazon’s Prime Day held on July 11-12, big-box retailers orchestrated a symphony of parallel promotions, endeavoring to captivate customers in a time when discretionary spending faces restraint. Beyond Prime Day, July boasts a tapestry of significant retail events, including 4th of July sales, Christmas in July, Black Friday in July, and the Nordstrom Anniversary Sales. With the advent of back-to-school shopping, all of which signal retailers to devise ingenious strategies to outshine the competition.

In this relentless pursuit of consumer engagement, Engagement Labs evangelizes the importance of fostering dynamic consumer conversations. Understanding that such offline and online act as catalysts for sales and brand success, retailers are called upon to harness the power of consumer interactions and inspire buzz that resonates across both online and offline channels.

Amazon Reigns Supreme

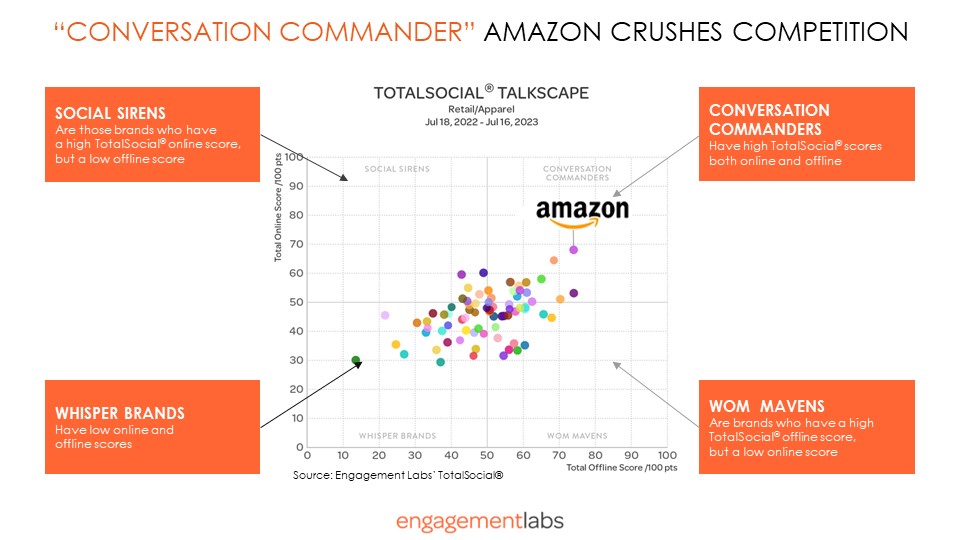

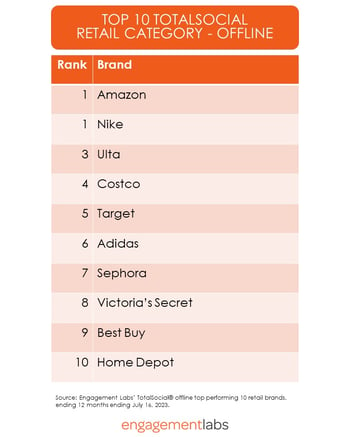

Back in spring 2018, we released the white paper, “5 Ways to Beat Amazon, The Retailers Guide to Harnessing The Power Of Social Influence To Drive Sales.” Five years later, Amazon continues to be a Conversation Commander, which is defined as a brand that performs above-average both offline and online, and at number 1 spot for all categories (Overall TotalSocial, Offline and Online), but tied with Nike for the number 1 spot offline.

One key factor in Amazon’s success is the extent to which it dominates consumer conversations. Measured against the industry landscape as a whole, the well-known American brand crushes it on every measure. Consumers talk about Amazon more than any other retail brand – and by a significant margin, both online and offline. In fact, Amazon’s TotalSocial performance is the #1 versus all other brands in America. Much of the conversation about the brand is very positive. Not only does Amazon get talked about a lot, it also inspires sharing of its content, and it is a favorite of the most influential consumers.

Amazon’s strong performance in driving consumer conversations about its brand matters because consumer talk drives sales. According to Engagement Labs analytics, 19 percent of sales, on average, are driven by consumer conversations.

On the surface, this should be troublesome to Amazon’s competitors. Yet, with an analysis of consumer conversations data indicates many opportunities to improve. Yes, Amazon is the clear winner across many categories and its strengths are significant, but to think it can’t be beat is dead wrong.

Data from Engagement Labs reveals that a few retailers are leveraging consumer conversations in a way that enables them to compete effectively with Amazon in the battle for social influence. With greater attention to the power of online and offline data, these retailers have a legitimate shot at grabbing back consumer engagement—and business. And the rest of the retail community can learn from them.

Top 10 TotalSocial Retail Category Rankings

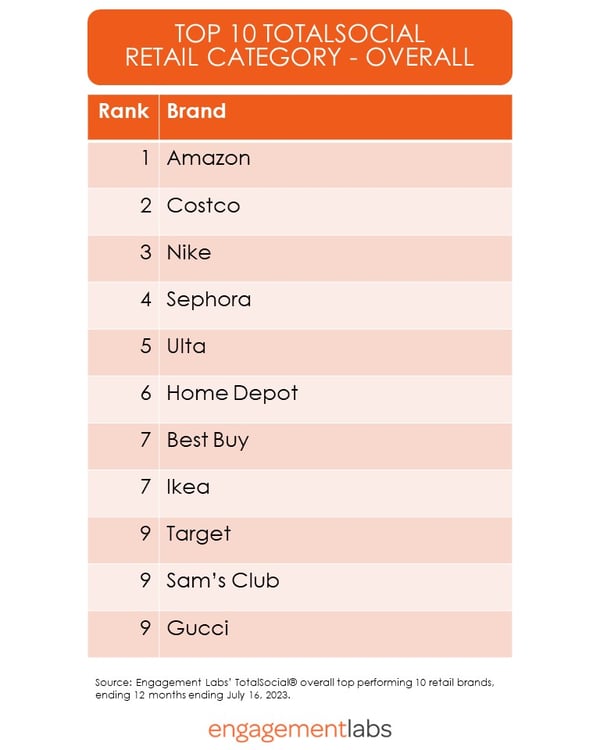

The rankings analysis is unique in that the TotalSocial combines offline and online consumer conversations and is based on Engagement Labs’ patented, proprietary TotalSocial data and analytics, which continuously measures the most important drivers of brand performance in both face-to-face (offline) and social media (online) conversations. The brands in the top 10 have earned the highest TotalSocial scores in the category for the 12 months ending July 16, 2023.

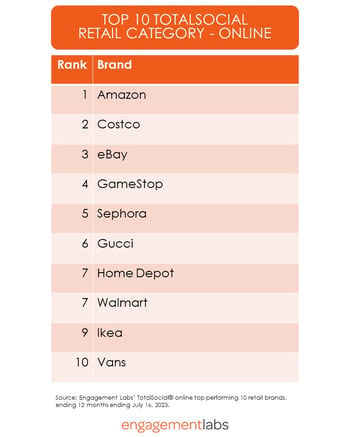

In the Overall TotalSocial ranking, Amazon, Costco, and Nike lead the pack, excelling in engaging consumer conversations both online and offline. Amazon and Nike tie for first place in the Offline TotalSocial category, while Ulta emerges as a strong contender in the top three. In the Online TotalSocial sphere, Amazon remains the frontrunner, accompanied by Costco and eBay in the top three, showcasing their expertise in fostering online consumer engagement. These rankings provide valuable guidance for retailers, shedding light on brands that have effectively leveraged TotalSocial power and offering insights for those seeking to challenge Amazon in the competitive retail landscape.

A notable discovery from the rankings is that Adidas secures a spot in the top 10 Offline, but lags behind in the online sphere, granting Nike a competitive edge. While both brands exhibit robust offline performance, Adidas must focus on bolstering its online presence to avoid falling further behind Nike's dominant position in the digital arena.

5 Recommendations for Retailers to Beat Competition

In the current landscape of 2023, brands with strong word-of-mouth (WOM) momentum should seize the opportunity to further amplify their buzz, while those lagging behind must put in extra efforts to improve their trajectory.

As a marketer planning to optimize your Holiday 2023 outcomes, competing with Amazon and other conversation commanders requires a well-crafted strategy supported by data that acknowledges the evolving landscape of consumer engagement. Here are recommendations on how to effectively compete with other e-commerce sites and retailers:

Cultivate Engaging Campaigns and Newsworthy Content

Cultivate Engaging Campaigns and Newsworthy Content

Retailers must craft campaigns and content that capture consumers' attention and ignite conversations about their brand. Embrace innovation by introducing compelling product lines, employing humor in advertising, and seeking strategic celebrity partnerships. These activities have the potential to spark discussions, both online and offline, and enhance brand visibility.

Harness the Power of Both Online and Offline Channels

Harness the Power of Both Online and Offline Channels

Recognize that success in today's retail market hinges on optimizing both online and offline consumer touchpoints. Tailor distinct strategies for each realm and create synergy between them. For instance, design "friends and family" coupons to incentivize group shopping experiences and employ social media-driven discounts for in-store purchases. By fostering dialogue in both spheres, retailers can maximize consumer engagement and drive sales.

Walmart presents an intriguing case, ranking impressively high in the online realm but lagging behind at 23rd place offline and #15 overall. This disparity is attributed to lower brand sharing, influence, and sentiment scores, which indicates a potential marketing opportunity for the brand. By focusing on enhancing the positivity of their conversations and targeting more influential consumers, Walmart can leverage this opportunity to strengthen its overall performance and bridge the gap between its online and offline standings.

Leverage the In-Store Experience as a Unique Advantage

Leverage the In-Store Experience as a Unique Advantage

Retailers possess an intrinsic advantage over Amazon through their physical stores. Capitalize on this by enhancing the in-store experience to encourage customer interaction and online sharing. Whether it’s selfie stations and other interactive elements that prompt customers to capture moments and share them on social media. Such offline conversations wield substantial influence over sales and brand perception.

Target Everyday Influencers and Influencers with Expansive Social Networks

Target Everyday Influencers and Influencers with Expansive Social Networks

Identifying and engaging with influencers who boast significant social networks can significantly impact a retailer's reach. Develop tailored programs for passionate brand advocates, many of whom are repeat visitors to your websites. By nurturing relationships with influencers, retailers can tap into their vast audiences and stimulate conversations around the brand.

Foster Shareable Marketing across Channels

Foster Shareable Marketing across Channels

To optimize conversations, retailers should design marketing initiatives that are inherently shareable across various channels. Implement integrated campaigns that leverage captivating OTT and TV advertising to prompt social media engagement. Seamlessly integrating both spheres of conversation allow retailers to amplify their messaging and increase the likelihood of consumers sharing content with their networks.

By embracing these strategies, retailers can navigate the competitive landscape with Amazon, effectively commanding consumer conversations and securing a thriving position in the market.

Sign up for a free briefing to find out your TotalSocial Score, learn how your TotalSocial Score compares to other brands and to discuss how to maximize your TotalSocial performance.