The UK is famously a nation of shoppers, and not surprisingly, shops and shopping is something we Brits love to talk about. That’s true even as footfall declines and many famous High Street names struggle.

In terms of online buzz, retailers such as Amazon generate huge amounts of posts and conversation in online social media. And in real-world and dark-social conversation, retail brands are even more prominent – of the top 10 most talked-about UK brands, five are retailers.

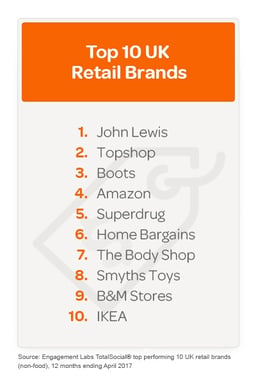

Volume of conversation is not the only component of social success – our TotalSocial® measurement programme also factors in Sentiment, Brand Sharing (sharing of brand content) and engagement among Influencers. Taking all four of our KPIs into account, and both Online and Offline/Dark channels, we rank UK non-food retailers as follows:

We view John Lewis as the clear leader, driven by its extremely strong Offline (word of mouth) performance, with exceptionally high sentiment in real-world conversation, strong volumes and high brand sharing. Of course the hype around the brand’s Christmas campaign is a big factor, but JL is an above-average performer all year round.

In the US, Amazon topped our rankings and not surprisingly they score high in the UK. Not the highest though: online-only retailers lack the physical presence that drives the high volume of conversation for brands like Boots, Next or M&S. And the Amazon shopping experience, though superbly efficient, is possibly almost too consistent – customers are clearly satisfied but a ‘visit’ there is not always a talking point. As omnichannel retailers figure out the right balance between click and brick, the social value of real stores needs to be factored in.

Great value is also a big talking point, and it’s notable that a number of discount brands rank high on our list, such as B&M and Home Bargains. These are stores still being discovered by some, and that combined with a strong value proposition gives them strong social capital, both Online and Offline. With the advent of Aldi & Lidl, UK shoppers of all wallets are happy to admit they shop in hard discounters – arguably this was not true in the days of brands such as Kwiksave. And hence shoppers of all pockets are happy to talk about brands like B&M to any kind of friend they have, knowing it will be relevant (& accessible) to pretty much everyone. Plenty of higher-income people talk about these brands.

The mix of retailers in our list of top social performance includes stores of all kinds, not just the online stars. Proof that a distinctive story, great value and good service can still get you talked about, by shoppers of all ages.

Want to learn more about how holistic online and offline social influence drives sales success? Check out our ebook, Lessons from the UK Leaders of Social influence, for more.