Beauty and Personal Care Brands Nivea & Colgate Thrive, As Do Household Cleaning Brands Tide and Gain, and Beverage Brands Keurig and Jack Daniel's

It’s been a very long time since everyday household products were deemed worthy of conversation over the dinner table, and probably never before (or rarely at best) were they fodder for posts and shares on Twitter and YouTube. Yet that is one of the outcomes of the COVID-19 pandemic that has maximized time spent at home and generated consumer enthusiasm for “spring cleaning.”

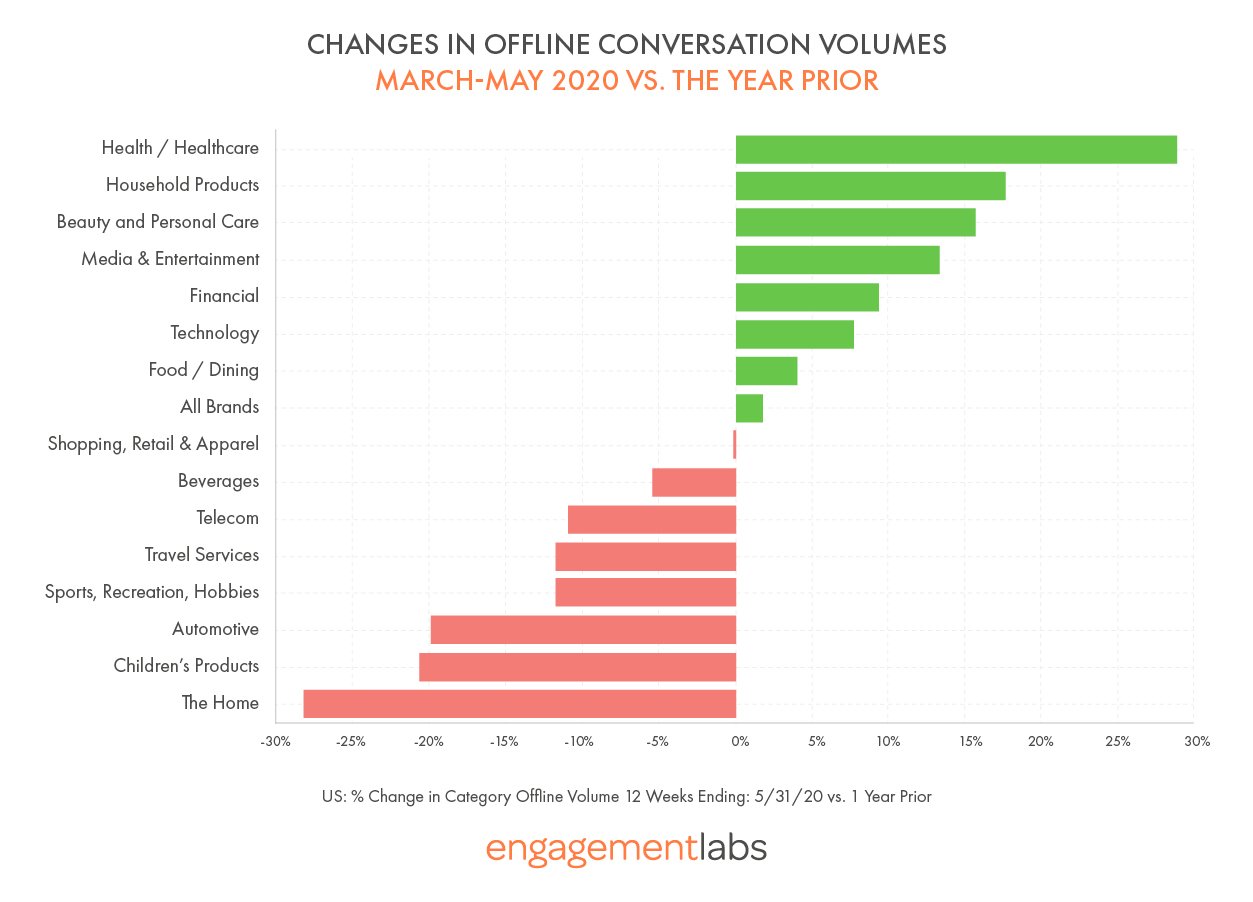

Consumer conversations changed dramatically during the COVID-19 pandemic, as categories such as health care, at-home entertainment, household products and beauty and personal care are becoming much more frequently talked about. At the same time, categories such as sports, travel, and automobiles are losing conversation engagement quite dramatically. Offline conversations about health and health care during March through May this year are up almost 30% versus a year earlier, while household and beauty products are up over 15%, and media/entertainment brands are up more than 10%, with the surge we reported for Disney+ conversations emblematic of that shift. That post highlighted the top 10 offline and online brands across all categories listed below. Here we dig deeper into individual categories.

Engagement Labs’ TotalSocial platform combines four types of metrics to calculate brand success in both online and offline conversations. Those metrics are the volume of conversation, the net sentiment (positive versus negative direction), the extent to which the brand is being talked about by the most socially connected people, and whether the brand’s advertising, marketing and social content is being shared and discussed.

Perhaps the most unexpected shifts come in the decidedly unglamorous everyday categories such as beauty and personal care, beverages, and household cleaning products, categories that took on new importance as time spent at home surged and in certain cases favorite brands were not always available. As a result, consumers began searching for new solutions to everyday needs and word of mouth helped fuel the process.

Household Products Benefit as Spring Cleaning Becomes Sexy?

Everyday necessity brands like Tide and Gain are gaining in the TotalSocial rankings, likely due to increased consumer appreciation, as well as a determine decision by their owner, Procter & Gamble, to “push forward not back” when it comes to advertising and marketing. Indeed, P&G brands own the first four spots in the household product offline ranking, including Febreze and Downy, each improving on last year’s score for the same March-through-May period.

P&G’s success is not universal however, as its Dawn detergent has dropped while arch-rival Palmolive has risen.

In terms of online conversation, P&G’s Downy brand enjoyed the largest rise in the rankings, to number two, likely due to a humorous ad campaign about “frisky grandparents” that launched before the pandemic but may have taken on added significance as families found themselves cooped up together. Lots of cleaning brands, including Colgate-Palmolive’s Fabuloso at number one, have jumped up high on the social media list, perhaps benefiting from the most enthusiastic “spring cleaning” season in decades, as homebound consumers have been keeping themselves busy and feathering their nests.

Another factor may be that at this late stage of the “soap wars,” it possible that the pandemic’s impact on reviving television audiences, particularly among the young and during the daytime, has helped to drive up conversation about brands traditionally advertised on daytime television.

Coffee and Alcohol Brands Attract Attention Online & Offline

The beverage category also shows signs of the pandemic’s impact on conversations. The biggest gainer both offline and online is Keurig, rising to the second position behind Coca Cola for offline conversation and to ninth place in social media. With the end of commuting for most of the country, consumers are making their own coffee at home rather than stopping by a deli or convenience store on the way to work, which has led to higher volumes of conversation for the brand.

Even while working hard to keep up with demand for machines and coffee pods, Keurig generated significant brand love by donating thousands of brewers and K-cup pods to hospital workers. In a stroke of good timing, Keurig also had just launched a cocktail mixing machine at a time when Americans are rediscovering cocktails during “Pandemic happy hours.”

Keurig’s sister brand Dr. Pepper is also doing well, ranked fourth in both online and offline conversation.

Other top-ranked brands in social media are Red Bull, which held on to its top spot, followed by Bud Lite and Jack Daniel's, which has risen more online than any brand other than Keurig. Indeed, half the top-ten online conversation brands are in the beer and liquor categories—including Miller Lite, Coors Lite, and Budweiser-hinting at another way changing lifestyle during the pandemic are impacting consumer talk.

Beauty & Personal Care Brands Gain, Despite Stay-at-Home Orders

Nivea and Colgate have risen over the last year to become the top two ranked brands for offline conversation in personal care and beauty, while Revlon and Dove have held on to top rankings for online conversation.

Beauty and personal brands continue to attract conversation, even though the shift from offices to working from home has reduced demand. Nivea has lowered its revenue expectations due to the pandemic, but the brand is enjoying more positive conversations, possibly due to its empathetic pandemic-related marketing.

The Colgate personal care brand also has seen its position improve year-over-year with steadily rising offline conversation sentiment in 2020, as well as a peak in volume in March when many consumers were focused on buying everyday staples amid the lockdowns.

In social media, Revlon held its strong position as 2019 leaders Bath & Body Works and Burt’s Bees dropped down the list, thus earning first place in the TotalSocial rankings. In May, Revlon had a hugely successful Twitter post from Gal Gadot, showing the actress and Revlon model trying new makeup with one of her daughters at home, perhaps a subtle nod to how even the rich and famous were surviving the COVID-19 lockdown.

Bath & Body Works, meanwhile, dropped from first to tenth on the list, mainly due to steadily eroding sentiment about the brand, particularly in late March when it’s parent company, L Brands, announced widespread layoffs due to COVID-19. Burt’s Bees dropped from second to sixth on the list due to steadily eroding volume and sentiment.

Click on the categories below for their respective list of the top ten online and offline brands:

- ALL Categories

- Automotive

- Beauty and Personal Care

- Beverages

- Dining

- Financial

- Food

- Health and Health Care

- Household Products

- Media, Entertainment and Sports

- Retail, Apparel and Supermarkets

- Technology

- Telecom

- Travel