But Nike Should Benefit from Higher Brand Engagement

Was Nike terrible, arrogant, or brilliant to launch a new “Just Do It” campaign featuring the controversial former NFL player Colin Kaepernick, who is famous for protesting social injustice during national anthem ceremonies on television? The answer has to do with understanding several critical marketing principles: Know your market; be relevant; engage consumers. On these dimensions, Nike is winning.

Superficially, Nike has reason to worry. Engagement Labs monitors conversations about brands that occur online in social media, as well as offline, usually face-to-face and over the kitchen table, at a water cooler, in a health club. We’ve seen negative trends in both kinds of conversations for Nike.

During the Trump presidency, numerous brands have been caught up in politically charged controversy, including Delta, Dick’s Sporting Goods, Citibank, Starbuck’s, and Nordstrom. In almost every instance, we’ve seen online and offline conversations track in opposite directions, with social media going negative while the more representative offline conversations get more positive. Most dramatically, Dick’s Sporting Goods got beat up in social media after tightening gun sale policies in the wake of the Parkland, FL school shooting tragedy. But offline conversations became more positive. Which type of conversation provided the better signal? Despite negative expectations, Dick’s ultimately reported strong sales early this year, leading to a 20% increase is stock. The offline conversations mattered much more.

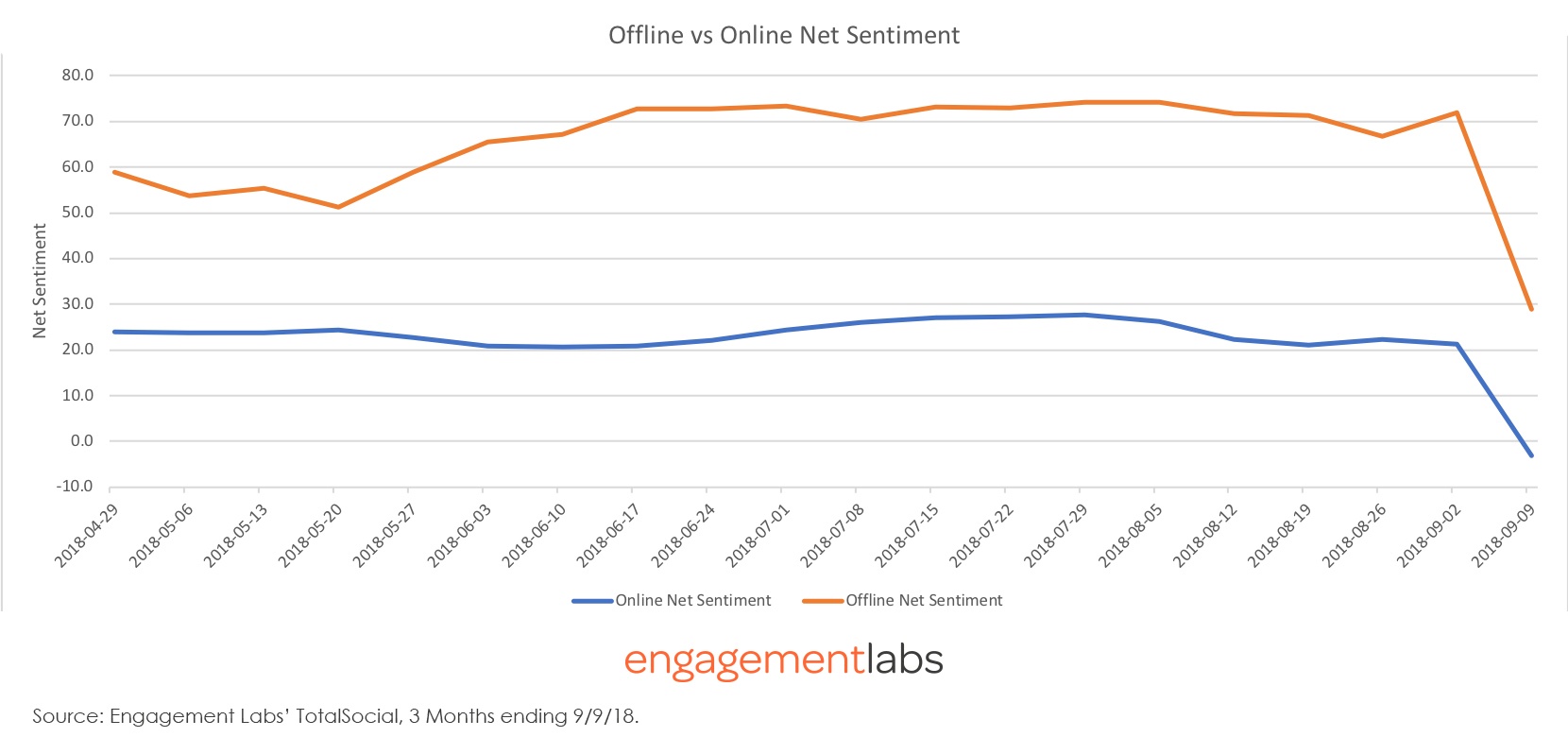

In Nike’s case, however, both the online and offline conversations have turned quite negative during the week after the Kaepernick campaign launched. Subtracting negative from positive conversations, the online “net sentiment” for Nike dropped from +21 to -3. The offline conversation sentiment also dropped from +72 to +29, still positive, but the worst overall sentiment score we’ve seen for the brand.

Nike Offline vs Online Net Sentiment

So, is Nike in trouble? Not necessarily.

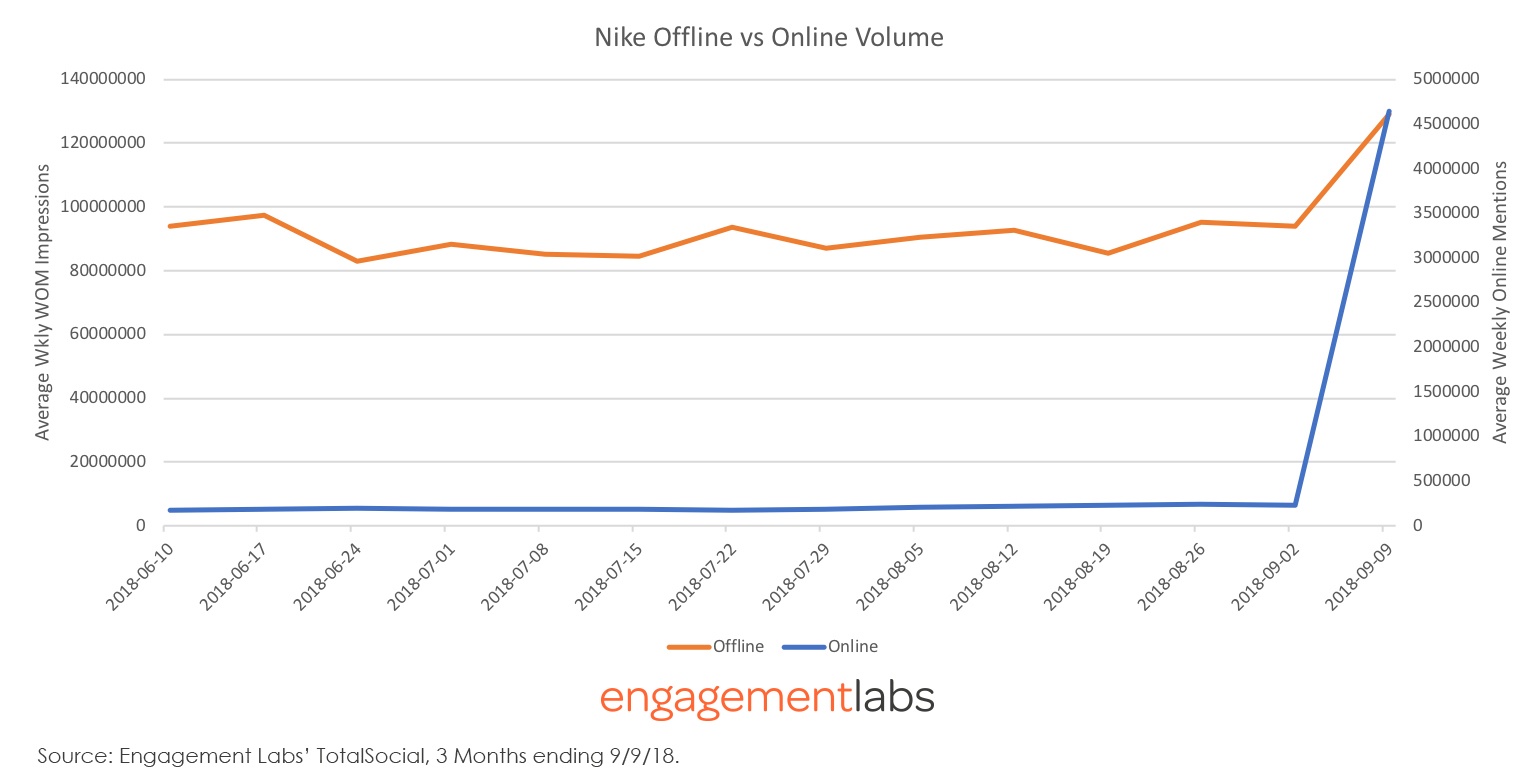

The other key factor is the level of engagement with the brand. The number of conversations happening about Nike in the campaign’s first week blew up, offline and online. In social media, the number of mentions that week hit over 4.5 million, compared to a typical week of about 200,000 mentions. Offline grew dramatically also, up to about 130 million from a more typical 90 million.

Nike Offline vs Online Volume

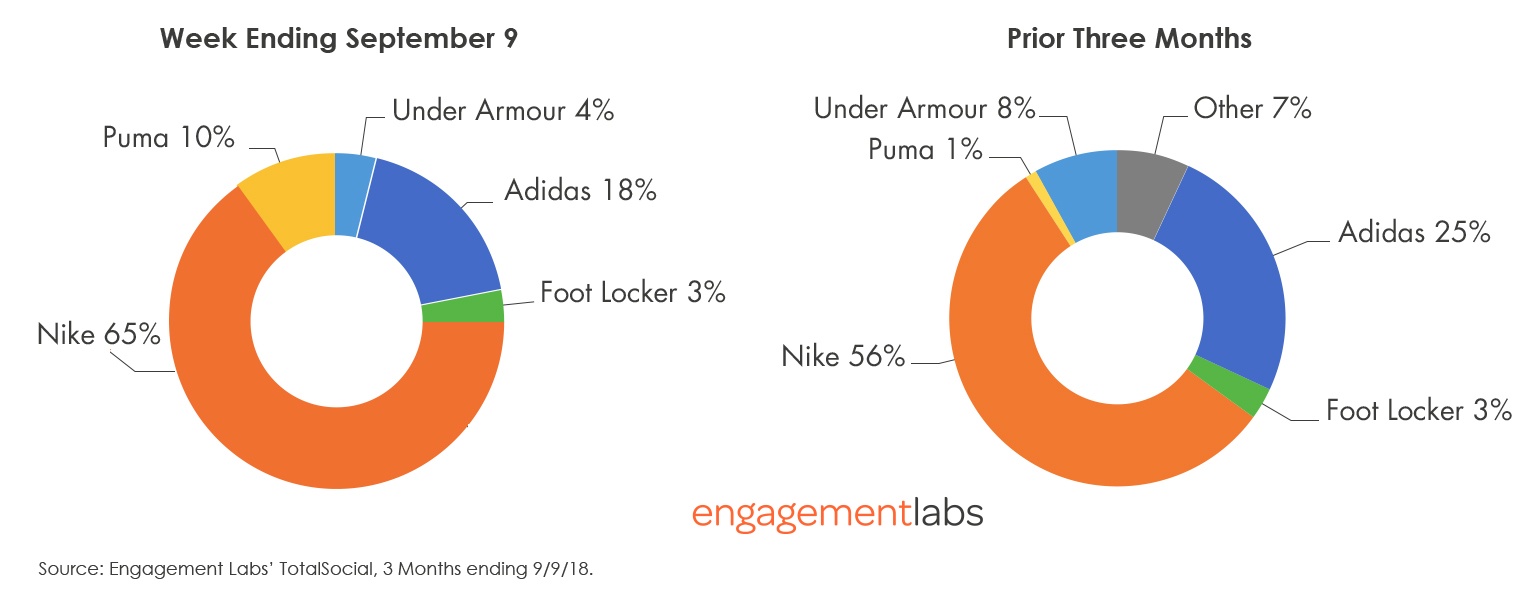

True, many of these increased conversations were negative about the brand. But many were positive. In fact, positive conversations alone grew 9% offline and 4% online the first week of the campaign versus the prior three-month average. Looked another way, the overall increase was large enough that Nike actually gained conversation “share” among positive conversations, hitting 65% of all positive conversations in the athletic apparel category, up from 56% for the three months prior to the campaign. It’s share gains were at the expense of Adidas above all others.

Positive Share of Talk

Nike’s share of negative conversations grew even more, but there’s an argument to be made that the higher engagement, including higher positive engagement, is worth some blow back, particularly if some of those people complaining are not among Nike’s core target audience, which is young, urban, and diverse. Our offline data suggest that, in fact, the negative conversations were from older, white, Republican-leaning consumers who normally don’t talk about Nike—or buy is products. Nike, in fact, has a strong track record of understanding its core, youth market. Our recent report on Generation Z found that Nike was one of the only apparel brands gaining traction with today’s teenagers, prior to the new campaign, and that today’s teens are more focused than other consumers on social justice among other political topics.

To understand the logic behind Nike’s bold new campaign one must recognize the brand knows its target consumers very well; it also knows how to renew its relevance to each successive generation of American consumers. Most of all, Nike has a knack for engaging consumers. In our view, the best measure of engagement is conversation—online and offline—and in that sense Nike has scored big.